Traveling is an adventure filled with excitement and unpredictability. While we often focus on the itineraries and experiences, it’s crucial not to overlook one essential aspect: travel insurance. In the ever-changing landscape of global travel, especially in the context of COVID-19, securing the right travel insurance has become more important than ever. This guide will walk you through the best travel insurance options in the Philippines, helping you make an informed choice for a worry-free journey.

Top Travel Insurance Options in the Philippines

1. OONA Travel Insurance

When it comes to comprehensive coverage at competitive prices, OONA Travel Insurance stands out. Offering up to ₱5 million in coverage for medical, hospitalization, and travel inconveniences, OONA ensures that you and your family are well-protected. With premiums starting at just ₱330, it provides an affordable yet extensive safety net.

Key Benefits:

- Up to ₱5 million coverage for medical emergencies abroad.

- 24/7 worldwide protection and assistance services.

- Cashless medical assistance, akin to HMOs.

- Coverage for COVID-19-related medical treatment for both domestic and international trips.

2. PGAI Travel Shield Insurance

PGAI Travel Shield Insurance offers tailored coverage options for international travel, with a focus on medical and emergency expenses. With up to ₱2.5 million coverage and premiums starting at ₱361, it’s an excellent choice for those seeking robust protection.

Highlights of PGAI Travel Shield Insurance:

- 24-hour Worldwide Assistance with the ability to call collect for support.

- Cashless claim settlements up to the policy limit.

- Inclusion of COVID-19 in the Medical Necessary Expenses Benefit.

- Emergency Medical Evacuation and Repatriation Benefits.

3. PGA SOMPO TravelJOY Plus

PGA SOMPO’s TravelJOY Plus is designed for the happy traveler who prioritizes safety. It offers up to ₱2.5 million in medical expenses coverage, with premiums starting at ₱463. This plan stands out for its inclusivity, covering individuals from infants to seniors up to 85 years old (99 for Schengen Visa Countries).

Notable Features:

- 24/7 hotline assistance and mobile support.

- Cashless benefits for emergency treatments or hospitalizations.

- Special cruise coverage.

Comparing Travel Insurance Premiums for Popular Destinations

When planning an international trip, one of the key considerations is the cost of travel insurance, which can vary significantly depending on your destination. This section provides a comparative analysis of travel insurance premiums for some popular destinations among Filipino travelers, helping you make a budget-conscious decision.

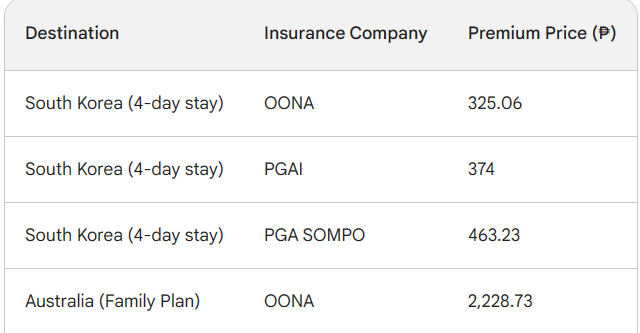

For example, a short 4-day trip to South Korea can see varying insurance costs. With OONA Travel Insurance, the premium is approximately ₱325.06, offering substantial coverage. In contrast, PGAI Travel Shield Insurance sets their premium a bit higher at ₱374, with PGA SOMPO TravelJOY Plus coming in at ₱463.23. This variation in pricing is reflective of the different coverage options and benefits each company offers.

You may check out a sample price comparison per destination here:

Moving to a different region, let’s consider Australia – a favorite destination for many. For a family plan, which generally provides coverage for two adults and children, the premiums can be more substantial due to the broader coverage required. OONA’s premium for such a plan in Australia is about ₱2,228.73. This increase in premium cost reflects the added risk and extended coverage necessary for family travel.

When comparing these premiums, consider the nature of your trip and the specific needs of your travel party. A solo traveler on a short trip may find a basic plan sufficient, while families or those engaging in adventure activities may require more comprehensive coverage. Additionally, some destinations may have higher medical costs or greater risks, which can be reflected in the insurance premium.

Remember, the peace of mind and security travel insurance provides can be invaluable, especially in unfamiliar destinations or in case of unexpected events. So, while considering the costs, also weigh the benefits and coverage each plan offers to ensure a worry-free and protected travel experience.

Why You Need Travel Insurance

The unpredictability of travel makes insurance a necessity. From delayed flights and natural disasters to medical emergencies, travel insurance provides a safety net. It covers lost passports, baggage issues, trip cancellations, accidents, and even death. Particularly with the prevalence of COVID-19, insurance acts as a crucial buffer, offering peace of mind and financial protection.

Travel insurance isn’t just about addressing the unexpected; it’s about ensuring a worry-free experience. Here are the most common types of coverage:

- Personal Accident Benefits: This covers death and burial expenses if the insured suffers a fatal accident or permanent disability during the trip.

- Travel Inconvenience Benefits: Compensates for expenses due to delays, cancellations, and other travel inconveniences.

- Medical & Hospitalization Benefits: Crucial for hospital stays and medical care abroad.

- Personal Liability Benefits: Reimburses for loss of personal items like baggage and documents.

Each of these coverages ensures that the financial burdens of unforeseen events are minimized, allowing you to focus on recovery or resolution.

Customizing Your Travel Insurance

Travel insurance can be tailored to fit your trip’s needs, whether it’s a once-in-a-year vacation or frequent international travel.

For Trip Frequency:

-

- Single trip policies are ideal for occasional travelers.

- Multi-trip policies suit those who travel several times a year.

- Annual trip insurance is perfect for regular jetsetters, offering 365 days of coverage.

For Individuals Covered:

-

- Single policies cater to solo travelers.

- Family plans are designed for families, including members below 18 years.

- Group plans offer convenient options for large groups, often with discount rates.

Choosing the right policy depends on how often you travel, who you travel with, and what kind of coverage you need.

Special Considerations for Schengen Travel

For those planning a trip to Europe, Schengen-compliant travel insurance is a must. Not only is it a requirement for a Schengen Visa, but it also needs to cover the entire duration of stay with a minimum coverage of €30,000 for medical emergencies and repatriation. Filipino companies like OONA, Standard, and Malayan offer such policies, ensuring you meet visa requirements while being adequately protected.

Payment Methods and Ease of Access

The digital era has simplified the process of buying and managing travel insurance. You can pay premiums through various methods, including:

- Debit or credit cards.

- Auto-debit arrangements.

- Online banking websites and apps.

- Over-the-counter at banks and payment centers.

- Post-dated checks.

These options offer flexibility and convenience, allowing you to manage your travel insurance from anywhere in the world.

Filing Insurance Claims: A Step-by-Step Guide

In case of an emergency or issue during your trip, it’s important to know how to file a claim:

- Contact your insurer immediately when an incident occurs.

- Gather proof such as police or medical reports, receipts, and other relevant documents.

- Fill out the claim forms provided by your insurer.

- Prepare the necessary documents for your specific claim type.

- Submit all documents and proofs to your insurance provider.

Note: Each insurance company has its specific requirements, so it’s essential to check these in advance.

Video: How to Get Travel Insurance?! | JM BANQUICIO

Still undecided on what travel insurance to get for your next international trip? Check out this video shared by travel blogger, JM Banquicio, where he shares his go-to travel insurance for the convenience, budget-friendly features, and overall ease of use. Be sure, however, to check the fine print so you can be assured that you have all the coverage that you need as some do not cover pre-existing conditions, and some other features. Again, the main thing here is to do your due diligence to research each package’s terms and conditions once you have your options presented to you.

Frequently Asked Questions

1. Is travel insurance mandatory for international travel?

It depends on the destination. Some countries, especially those in the Schengen Area, require travel insurance for visa issuance. Even if not mandatory, it’s highly recommended for unforeseen events.

2. Does travel insurance cover COVID-19-related issues?

Most modern travel insurance policies now include coverage for medical expenses related to COVID-19. However, coverage for trip postponements or cancellations due to the pandemic may vary, so check the specific policy details.

3. What is the best time to purchase travel insurance?

Ideally, buy travel insurance soon after booking your trip. This ensures that you’re covered for any potential trip cancellations or other unforeseen events leading up to your departure.

4. Can I get travel insurance for a single trip if I travel frequently?

Yes, but frequent travelers might benefit more from a multi-trip or annual policy, which can be more cost-effective and convenient than purchasing a single-trip policy each time.

5. Are there age limits for travel insurance?

Age limits vary by insurance provider. Some policies cover infants to seniors up to 85 years old, and others may have different age brackets. Always check the age limits before purchasing a policy.

6. How does destination affect my travel insurance premium?

Destinations with higher medical costs or perceived higher risks (like extreme weather or political instability) may have higher premiums. Insurance providers assess the overall risk of the destination when setting premiums.

7. Are adventure sports and activities covered by standard travel insurance?

Many standard policies exclude high-risk activities like extreme sports. If you plan to engage in such activities, look for a policy that specifically covers them or consider an add-on.

8. What should I do if I need to make a claim?

Contact your insurer immediately if an incident occurs. Collect and prepare necessary documentation like medical reports, police reports, receipts, etc. Then, follow the insurer’s process for filing a claim, which usually involves completing a claim form and submitting the required documents.

Conclusion

Choosing the right travel insurance is crucial for a hassle-free journey. With various options available, it’s important to consider your specific travel needs, destinations, and the types of coverage you require. The right insurance not only offers peace of mind but also ensures that you are well-prepared for any unforeseen circumstances during your travels.

READ NEXT: 10 Best Travel Agencies in the Philippines

Disclaimer: The information provided in this blog post is intended for general informational purposes only. It is not intended as financial, legal, or insurance advice. While we strive to present the most accurate and up-to-date information, insurance policies and their details, including coverage, premiums, and terms, are subject to change by the respective insurance providers. Therefore, we cannot guarantee the accuracy or completeness of the information at the time of reading. Readers are advised to conduct their own research and consult directly with insurance companies or qualified professionals before making any decisions regarding travel insurance.