You’re probably aware of how inconvenient it can be to manually pay your taxes at the BIR, especially since it’s risky due to COVID-19. The BIR’s online payment channels have made it more convenient way to pay taxes online. It eliminates the need for you to line up at the bank or RDO. You can pay your taxes using a credit or debit card, bank account, or mobile wallet.

Also Read: How to Register for BIR Tax as an Online Freelancer in the Philippines

Due to the tax filing season, the Bureau of Internal Revenue (BIR) has announced that it will no longer extend the deadline for filing your taxes. In line with this, BIR offers a variety of payment methods online. With this guide, you’ll learn how to make a quick and easy payment using one of the agency’s payment methods.

Why Pay Taxes Online?

Online tax filing has several benefits over paper filing. Here are the most compelling reasons to pay taxes online.

Safety

You can avoid crowds and long lines when you pay taxes online, lowering your chance of COVID-19 exposure. Furthermore, you do not need to bring a large amount of cash with you when you go out. You can file your taxes from the convenience of your own home.

Convenience

When you pay taxes online, the process will be quick and easy. You no longer need to make an appointment with a bank or payment center. The BIR intends to provide round-the-clock online tax services in 2022-2023. This means you can pay off your bills whenever and wherever you want.

Observance of the Tax Payment Due Date

Because BIR online payment is more convenient and convenient than manual payment, you are more likely to pay on time and avoid penalties for late payment.

Concentrating on the Operations of Your Company

Manually filing and paying taxes is a complicated and time-consuming process. Paying taxes online saves you time and allows you to focus more on growing your business if you sell things online. With BIR online payment options, it will be straightforward for online merchants in the Philippines to comply with tax regulations, now that the BIR compels online sellers to pay taxes.

Financial Transactions That Are Safe

When you make an online purchase, the transaction is encrypted, and your personal information is protected. Your online banking application or electronic wallet is not accessible to anyone else. The BIR also has a secure payment gateway via the Authorized Agent Bank’s e-Payment channels.

Authorized Payment Verification Using E-Receipts

When you pay electronically, you will be sent an e-receipt, which will serve as your official receipt. You can use this to file your tax return (ITR). The advantage of these e-receipts is that they are easy to save and retrieve in the event of a dispute about your transactions.

Here are some key points to remember from the BIR

- If April 15 falls on a holiday, the filing date for the Annual Income Tax Return will be moved accordingly.

- Taxpayers can file their AITR and pay their taxes through Accredited Agent Banks regardless of their Revenue District Office (AAB). For example, if your RDO is in Pasig but you live in Batangas, you can file in Batangas and pay with any of your favorite electronic payment options. Previously, payments could only be made within your RDO.

- For income tax payments, your Revenue Collection Officers can accept cash or checks. Make sure that any checks you write are made payable to the Internal Revenue Service. You may or may not include the IFO name and taxpayer identification number, as previously required.

- You can submit your AITR through the eBIR Forms System and pay through AAB, RCO, or electronic payment (ePay) facilities like Landbank of the Philippines, Development Bank of the Philippines, and Union Bank of the Philippines.

- To settle payments through BIR Taxpayer Software Provider, you can use GCash, Paymaya, or MyEG (TSP).

Important: Taxpayers who have to file their taxes electronically should do so. If they pay manually, this method will be considered a wrong venue filing. However, if the eFPS is not working, you can still use the eBIR Forms facility to file and pay. If the eBIR forms and the eFPS are not available, then you can use a manual filing or payment method.

BIR Online Payment Tips for First-Time Taxpayers

Paying your taxes online for the first time might be scary, especially if you’re used to doing so manually. However, if you follow these advice, it will be simple and stress-free.

Gather Your Documents

Before you begin, make sure you have all of the relevant documentation and information. You must have your forms, Taxpayer Identification Number, and other necessary information before logging onto the BIR’s online system. It’s best to have a physical copy of your login details, such as printing it or writing it down in a notebook, so you don’t forget them.

Examine Payment Instructions and Specifics

Check that all of the information you’ve supplied is correct. Check the spelling of the names, the sender and receiver, as well as the amount in pesos. If the bank account information is wrong, you will not be able to receive a refund once the payment has been sent.

Make Paper Copies of Online Transactions

Because you will receive digital copies of your transactions, such as payment acknowledgements and e-receipts, in your email, it is a good idea to save physical copies in case you accidentally delete your inbox.

BIR Online Payment Channels

You can use the e-payment options below to make payments to the BIR.

1. Channels of Online Banking

Who can make online payments: Those who have registered for the BIR Electronic Filing and Payment System can file and pay their taxes electronically (eFPS)

Bank transfer is an acceptable method of payment.

When you have a mobile banking app or an online account, it is considerably easier to make purchases and pay bills. Did you realize that it can also be used to pay taxes and other government fees? Because of the BIR’s involvement with several banks, including BPI, China Bank, PNB, and UCPB.

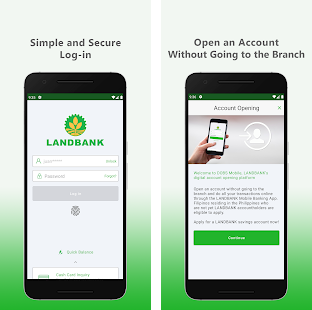

2. LANDBANK Link.BizPortal

Who can make online payments:

LANDBANK ATM customers with savings or checking accounts, BancNet ATM/debit/prepaid cardholders, RCBC and Robinsons Bank depositors that use the PESONet facility

Accepted payment methods include:

ATM, debit card, or prepaid card bank transfer

The primary role of BizPortal is to facilitate online payments for goods and services, but it can also be used to settle your BIR-related responsibilities. It accepts payments of various sizes. Landbank’s online banking capacity may also generate and issue online payment confirmation, which users can print or receive via email. You can file your taxes whenever you choose because it is available seven days a week, including holidays (with the exception of system maintenance).

3. DBP Tax Payment Online

Who can make online payments:

Holders of BancNet ATM/debit cards

Cardholders of Visa and MasterCard

Accepted payment methods include:

Debit card Credit card

DBP, a government-owned bank, provides a payment option that allows taxpayers to pay electronically by providing simply the TIN, Tax Type, RDO, Form Number, and Amount. Keep in mind that there is a fee for using the services of this institution.

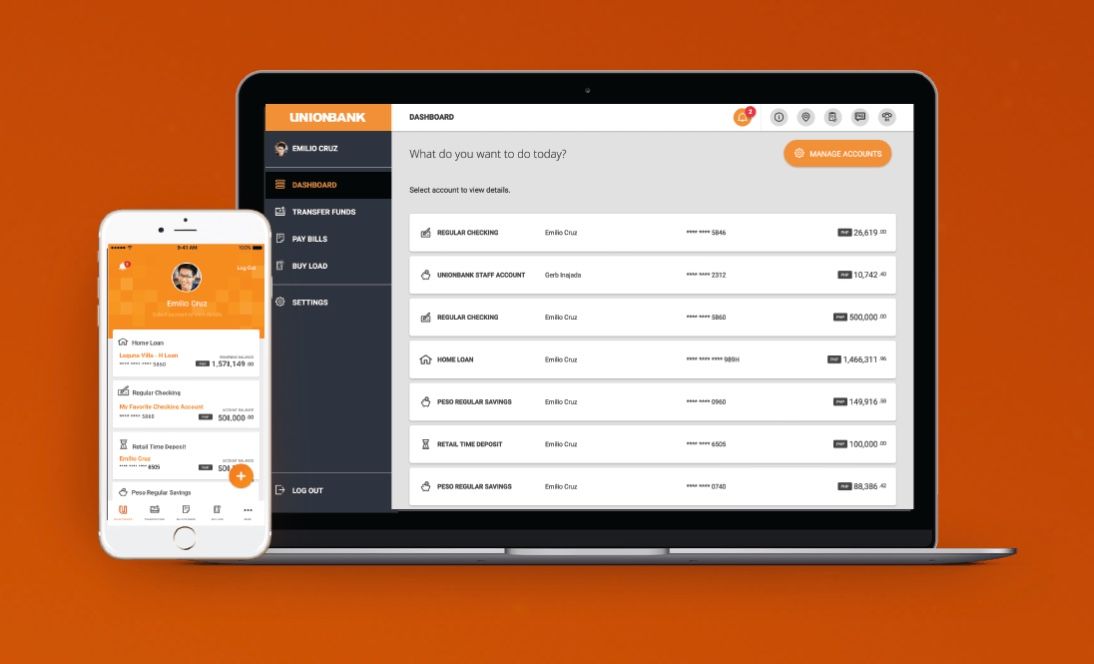

4. UnionBank Online app

Who can make online payments:

Taxpayers who have a UnionBank account

Bank transfer is an acceptable method of payment.

Many customers applaud the UnionBank Online app’s usability and efficacy. Opening a new UnionBank account is simple if you already have one. Because of its highly intuitive design, the software is straightforward to use.

5. GCash

Who can make online payments:

Taxpayers whose Globe or TM mobile number is registered with GCash and whose mobile wallet contains enough cash to pay their taxes

GCash Wallet is a legitimate payment method.

Because of its user-friendly and uncomplicated style, GCash is one of the most popular mobile wallets. This electronic wallet program simplifies the process of sending and receiving money. You can also pay the BIR online with GCash and avoid paying a service fee.

6. PayMaya app

Online payments are available to taxpayers who have a PayMaya account with sufficient funds to pay their taxes.

PayMaya wallet is accepted as a payment method.

PayMaya is another popular mobile wallet in the country. BIR is featured as one of the billers in the app’s Bills Pay section. Individual taxpayers can pay their taxes at any time, from any location, around the clock, thanks to PayMaya.

7. Money management app

Who can make online payments:

Taxpayers who have a Moneygment account and sufficient funds in their e-wallet to cover their taxes

Accepted payment methods include:

ECPay sDragonpay s7-Eleven monetary wallet

PayPal

Moneygment is an app that provides financial solutions to OFWs, housewives, and Filipinos who do not have banking experience. This program may be the best alternative if you own a small business and need to pay taxes. Moneygment is also designed for small and medium-sized businesses.

Moneygment also has strong relationships with reputable financial institutions, ensuring the security of your transactions.

8. Business Website Centralization

Who can pay online:

New Philippine corporations

The government has simplified business registration and compliance with BIR-related procedures using the Central Business Portal (CBP).

It is a one-stop shop for anyone looking for information on starting a business or obtaining a Taxpayer Identification Number (TIN). Furthermore, the previously described webpage can generate an electronic Certificate of Registration.

An additional CBP feature is the payment of the 500 yearly registration fee (ARF) and the 30 loose Documentary Stamp Tax (DST). On the other hand, corporate taxpayers may pay these expenses using any of the BIR’s online payment methods listed above rather than the CBP.

More information is available by visiting the Central Business Portal.

Step-by-Step Process to Pay Taxes Online Through eFPS

If you are a BIR Electronic Filing and Payment System (eFPS) user, you must first file your tax return through the eFPS website.

Following the completion of your tax filing, complete the following eFPS BIR online payment steps:

- Click “Proceed to Payment” to get to the eFPS Payment Form page.

- Select “Bank Transfer” as your payment method.

- From the list of Transacting Banks, select your bank institution.

- Enter the amount of your tax payment.

- Choose the Send option. Then click “OK.” This will take you to your bank’s online banking website.

- Log in using your online banking account.

- Pay your taxes to the BIR via the internet banking platform.

- Following the completion of your BIR online payment, a confirmation page will be shown indicating that the transaction was successful.

How to Pay BIR Online Tax Payment for eBIRForms Filers

The goal of the eBIR forms is to make filing and preparing tax returns easier and more convenient for taxpayers. Through the use of eBIR forms, the Bureau of Internal Revenue can improve the efficiency and accuracy of its data capture and storage.

Taxpayers and tax agents can now complete their returns using the downloadable eBIR Forms Software Package. This software allows them to submit their returns to the Bureau of Internal Revenue (BIR) through the Online eBIR Forms System.

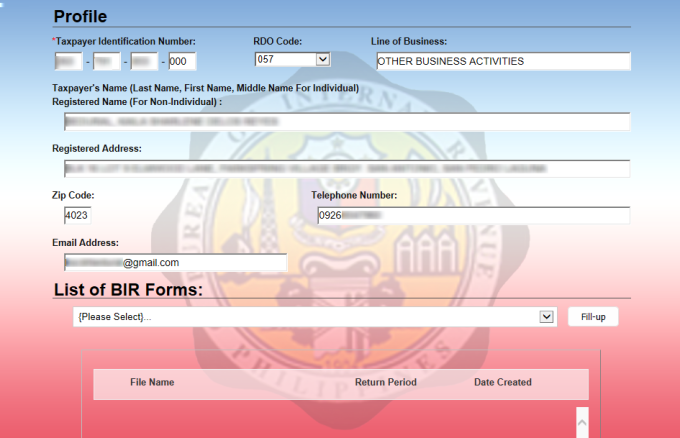

Online eBIRForms System

The Online eBIRForms System is a filing system that accepts online tax filings and automatically calculates penalties for late tax returns. The System enables ATAs to file on their clients’ behalf and establishes secure user accounts for taxpayers, ATAs, and Tax Software Providers (TSPs) to use the online System. The System also contains a means for TSPs to test and evaluate the data generated by their tax preparation software (certification is by form). TSP-certified tax preparation software can be used to import tax return data.

You can e-file your tax returns using the eBIRForms application. Fill out the required form, then click the “FINAL COPY” button.

Offline eBIRForms Package

Taxpayers and ATAs can now complete and submit tax forms offline using the eBIRForms Package. This software eliminates the need for manual processes and provides a more accurate and secure way to prepare tax returns.

Unlike pre-printed forms, which are prone to human error, the eBIR forms allow taxpayers to directly encode and manage their data.

This package can perform automatic calculations and provide the necessary validation for information encoded by Taxpayers and ATAs. After completing the forms, they can submit them to the eBIR forms system.

To file your taxes online, go to the BIR website and download the Electronic Bureau of Internal Revenue Forms (eBIRForms) package.

You can pay taxes online after completing and submitting your tax return using any of the BIR’s online payment channels.

NOTE: The eBIR forms are not for everyone. If you are one of the following individuals, then you should not use the forms. Instead, you can file manually.

How to Pay BIR Online via LANDBANK / PESONet

Through PESONet, a credit payment system, users can make electronic fund transfers. It’s an alternative to the traditional paper-based system.

In order to ensure that the funds are transferred in a timely manner, the PESONet fund transfers are generally processed in bulk and then cleared in intervals. However, they do not make real-time transfers. The receiver should receive their funds within the same business day if the amount has been transferred within the cut-off of the participating institution’s account.

The goal of this platform is to make payments convenient for both business-to-business and person-to-business transactions. For instance, it can be used to credit the salaries of employees.

Step 1: Go to the LANDBANK Link.BizPortal.

Step 2: Choose the Pay Now option.

Step 3: In the Merchant field, type “INTERNAL REVENUE BUREAU”. Select the Proceed option.

Step 4: Select “Tax Payment.” Select the Proceed option.

Step 5: Fill in your payment details as well as the captcha code. The Terms and Conditions must be agreed to. Select the Proceed option.

Step 6: Examine your payment information. Then enter your LANDBANK or BancNet account information and any other bank credentials.

Step 7: Continue with the online BIR payment and then click Submit. A payment confirmation will be shown and emailed to you.

How to Pay BIR Using DBP Pay Tax Online

Individuals can pay taxes online through Pay Tax, which provides two payment methods. One is through a debit facility, which comes with a fixed fee of Php 35, or they can use a credit or debit card for the payment.

Step 1: Had over to the DBP Pay Tax webpage. Fill out the Taxpayer Information form. Check the box to confirm that your information is correct.

Step 2: Select the Proceed option.

Step 3: Please provide your full name and email address.

Step 4: Check the box to confirm that your information is correct. Select the Proceed to Payment icon.

Step 5: Select your desired payment method. Continue to Payment by clicking the button.

Step 6: Enter your credit/debit card information (card number, CVV, and expiry date).

Step 7: Click the “Payment Confirmation” button. You will be able to download your transaction summary as a PDF file. Your transaction details will also be sent to you through email.

How to Pay BIR via UnionBank

Through the BIR’s accreditation, UnionBank can now provide its corporate customers with the ability to pay their taxes through an electronic filing and payment system. This facility will allow them to make payments in real-time.

The BIR’s e-payment facility for corporate users is very simple to use. All you need to do is log on to the agency’s website and select the internal revenue tax that you want to pay using UnionBank’s e-payment system. You will then be directed to the corporate e-payment facility of UnionBank.

You have the option to authorize e-payment immediately. This facility will provide you with a real-time acknowledgment number that will be used to confirm the successful transmission of your payment.

The second option is to authorize e-payment later. This facility was introduced in conjunction with the BIR’s recent ruling that allows taxpayers to avail of the e-filing of their tax returns without having to pay on the same day.

This new feature will allow you to follow the e-file schedule that’s indicated for your industry group. It will also allow you to pay taxes online on your preferred date to maximize your funds. You can now authorize e-payment transactions through the UNIONBANK’s website.

After you have authorized e-payment, a real-time acknowledgement number will be generated to confirm the successful transmission of the transaction to the BIR.

Step 1: Access UnionBank Online or the UnionBank mobile app to get started.

Step 2: Enter your user ID and password to access your online/mobile banking account.

Step 3: Choose “Pay Bills.”

Step 4: Select “Internal Revenue Service” from the Biller List.

Step 5: Enter the relevant payment information.

Step 6: Choose the UnionBank account that will receive your online BIR payment.

Step 7: Examine your payment information.

Step 8: To confirm your payment, click the “Pay” button. You will notice a payment confirmation, which will also be sent to you through email.

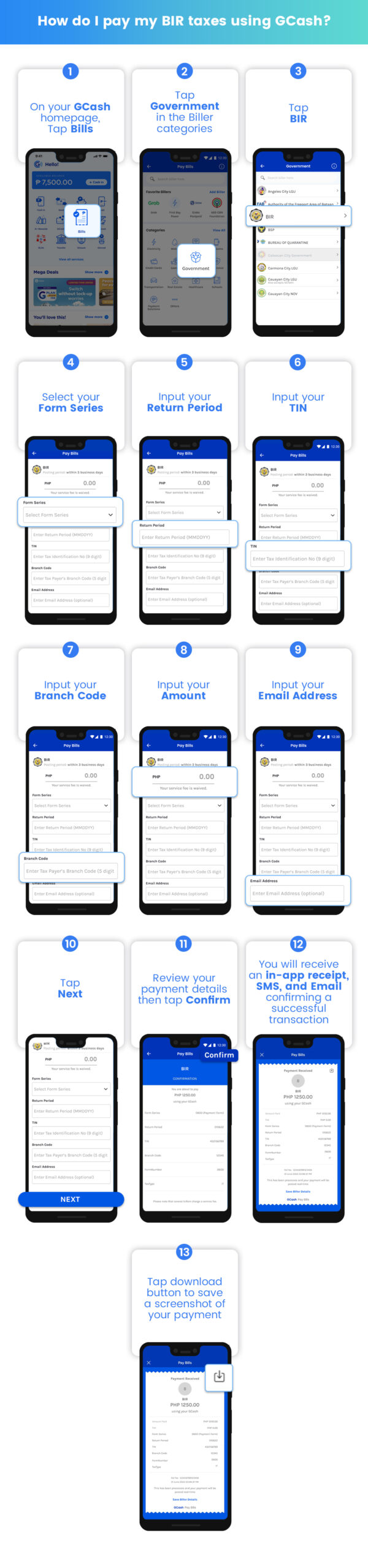

BIR Online Payment Using GCash

Through its partnership with the Internal Revenue Service of the Philippines, Gcash can help you pay taxes online, as well as other fees.

With Gcash, you can send payments securely and guarantee that they will be posted to the system.

Even if there are problems with Gcash, it’s easy to contact its customer support team by calling its 24-hour hotline or the help center.

Step 1: Log in to the GCash application using your four-digit MPIN.

Step 2: Select the Bill Pay option.

Step 3: Select “Government” and then “BIR.”

Step 4: Fill out the Pay BIR form.

Step 5:Confirm your payment information.

Step 6: Your payment confirmation will be shown. You will also receive a text message verifying the transaction’s success.

How to Pay BIR Using the (Pay)Maya App

BIR payments using the PayMaya app are as simple as shopping online. Individuals can pay their taxes anytime, anywhere using the app’s bill pay section.

Step 1: Log in to the PayMaya app using your credentials.

Step 2: Select the Bill Pay option.

Step 3: Enter “BIR” in the search area.

Step 4: Enter your tax information. Select the Proceed option.

Step 5: Examine your payment information.

Step 6: Tap the Pay button to confirm a BIR online payment.

Step 7: View the confirmation receipt on the screen. You will also receive payment confirmation via SMS and email.

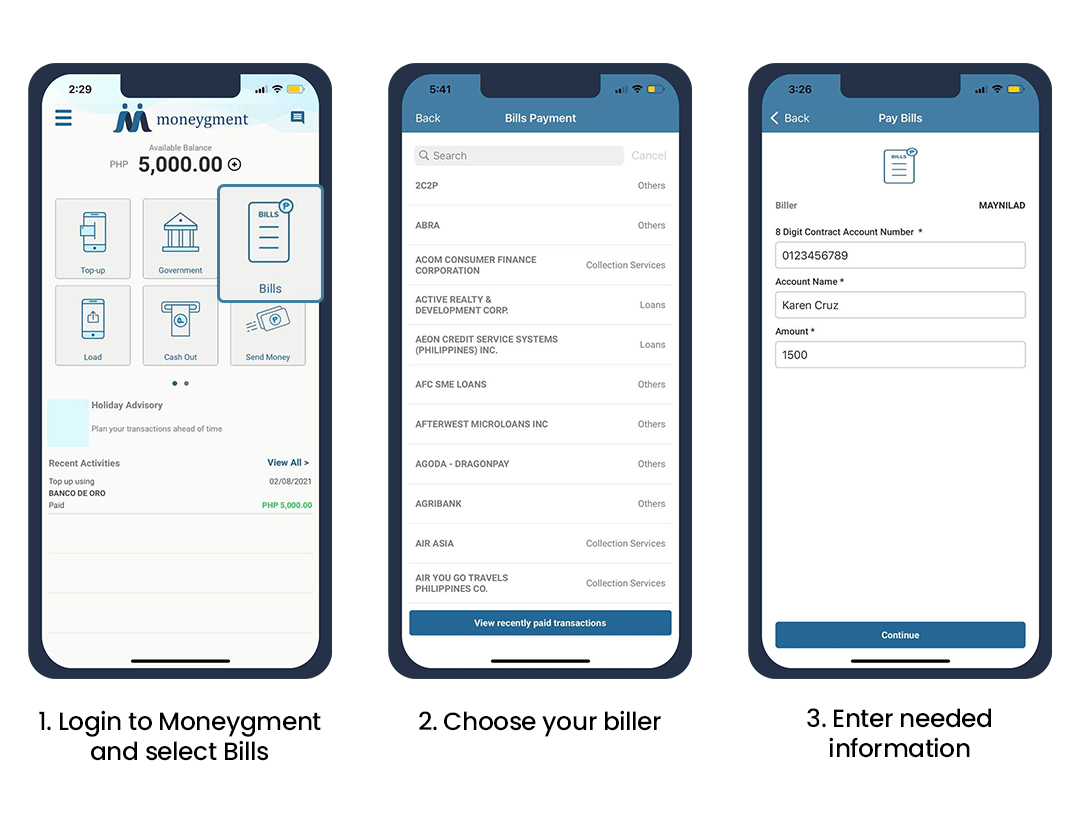

How to Pay BIR Using Moneygment App

Moneygment is a mobile app that provides a financial solution to Filipinos who are unbanked or self-employed. It can be used by small to medium-sized enterprises and OFWs.

Apart from being a mobile app, Moneygment also has social roles for users. Its goal is to make Filipinos financially included.

Step 1: Sign in to the Moneygment app using your credentials.

Step 2: “Calculate, pay, and file tax returns” will appear.

Step 3: “Create or update your profile” should be selected.

Step 4: Provide your tax information as well as your personal information.

Step 5: Fill in the blanks with your income and spending.

Step 6: Select “View your tax computation and pay” to file your taxes.

Step 7: Choose the appropriate tax term for your BIR payment. Select the Proceed option.

Step 8: Select your desired payment method. Continue by pressing the Continue button.

Step 9: Check your email for a confirmation of your BIR online payment.

Here are some tips to help you file your taxes online safely:

Even though the BIR’s online payment channels are equipped with security safeguards, it is always prudent to take precautions. When doing online financial transactions, you supply sensitive information such as your personal information and credit or debit card information. If it falls into the wrong hands, this may be compromised. Fraudsters and cybercriminals are rapidly changing, therefore you must take precautions.

Here are some considerations about the online payment of BIR taxes:

Tip #1: Install antivirus software

Your computer probably already has a security application installed. But does your mobile device have it? All the devices you use for internet tasks, such as paying bills, should have a robust layer of security. Otherwise, attackers may be able to exploit a vulnerability in your machine. They will then be able to get critical information about you, such as your bank account number and Social Security number.

Tip #2: Use a VPN

A virtual private network, or VPN, is a service that allows you to conceal your private data while browsing the Internet. This service is recommended by experts when utilizing public Wi-Fi. You may not require it when connecting to the Internet at home.

However, you can activate it if you are conducting sensitive and significant transactions, such as paying bills and taxes. Just be careful of “free” VPN services, as the vendor can actually be watching your internet activity.

Tip #3: Improve Your Passwords

This should be a simple precaution, yet many individuals still use weak passwords for their banking, bill payment, and tax payment accounts.

Avoid using the same password for several online accounts. If you believe it may be difficult to track or remember many passwords, utilize a password manager (Just make sure to use a trustworthy one).

Strong passwords are unique, so as much as possible, use random combinations of letters, symbols, and numbers. Moreover, treat your password as you would a toothbrush; periodically change it.

Tip #4: Ensure the Website Has a Cryptography Icon

When you’re utilizing a payment facility, always look for the lock icon on your browser. If the website you are using does not have it, you should not continue. Otherwise, your data is susceptible to tracking and theft. In addition to the lock symbol, ensure that the URL begins with “https” and not “http.”

Tip #5: Dispose of Information That Could Be Stolen

Never ever keep sensitive data or information, including passwords, ITIN, and bank account numbers, in a local drive or folder on your smartphone or computer.

If your gadgets are misplaced, thieves and hackers may gain access to these details. Make it a habit to dispose of sensitive information. However, before doing so, create a backup and store it in a secure location on an external hard drive.

Tip #6: Use a Unique Email Address.

Refrain from utilizing the same email address used for your social media accounts and online banking. Create a new email address not tied to your internet activity and surfing habits. This will prevent you from getting phishing emails and help protect your online banking accounts.

In 2021, about 500 million Facebook accounts have been exposed and displayed on a website that hackers frequent. Visit haveibeenpwned.com and enter your email address to determine if your email account was stolen in a data breach.

Following these tips, you can protect your accounts and data from being stolen. Be sure to update all of your passwords, especially for online banking and social media accounts. Create stronger passwords that are not easily guessed by hackers or computer programs designed to guess them.

Video: How To Pay BIR Annual Income Tax Online Using Gcash

In this video, the vlogger talks about how to pay BIR annual income tax online using GCash. He explains that the easiest way to do this is by registering your mobile number with the BIR. The process of paying taxes via GCash involves downloading the mobile app, creating an account and linking it to your bank account.

Frequently Asked Questions

1. What is an offline eBIRForms package?

This package can perform automatic calculations and provide the necessary validation for information that is encoded by Taxpayers and ATAs. After completing the forms, the submitted data will be processed by the Online eBIR forms system.

Taxpayers and ATAs can now complete and submit tax forms offline using the eBIRForms Package. This software eliminates the need for manual processes and provides a more accurate and secure way to prepare tax returns. Unlike pre-printed forms, which are prone to human error, the eBIR forms allow taxpayers to directly encode and manage their data.

2. What is the eBIRForms system?

The Online eBIR Forms System is a secure online filing system that allows taxpayers to submit their tax returns. It also computes penalties for those who submitted returns that were not filed within the due date. Through the system, individual taxpayers and tax software providers can securely access their accounts.

Through the System, which is a facility for testing and validating the data generated by tax preparation software, managed service providers (TSPs) can accept returns that have been filed using certified software.

3. What is monthly remittance return?

The monthly remittance of final income taxes is held on interest payments made on deposits and the yield on deposits.

4. What is eBIR form?

The goal of the eBIR forms is to make filing and preparing tax returns easier and more convenient for individuals. Through the use of this system, the Bureau of Internal Revenue can improve the efficiency and accuracy of its operations.

Taxpayers and tax agents can now complete their returns using the downloadable eBIR Forms Software Package. This software allows them to submit their returns to the Bureau of Internal Revenue (BIR) through the Online eBIR Forms System.

5. Who can use annual income tax return?

The Income Tax Return for use by corporations, partnerships, and other non-individual taxpayers is only available for use under the provisions of the Tax Code as amended. These include individuals who are exempted from certain taxes.

6. Is a corporation subject to regular income tax?

Non-individual taxpayers, such as corporations and partnerships, are required to file an annual income tax return. This type of return is only valid for the regular income tax rate.

7. Who are exempted from paying taxes in the Philippines?

The tax reciprocity rule allows Filipinos working overseas to avoid paying taxes in the Philippines. This is similar to how foreigners are treated when they are in the country and are not required to pay taxes at home.

8. What are the tax exempted from gross income?

Income tax is not payable on the following: The amount received as a return of insurance premium, and the compensation for injuries and sickness. Also, income from pensions, retirement benefits, and charitable donations is exempted from the tax.

Final Thoughts

With the start of a new year, one of the big things that many people prepare for is filing taxes. If you’ve never done this yourself, then this guide will offer some insight on how the payment process looks like.

That being said, isn’t a good thing that there are several ways for us to pay taxes online? With the advent of digital payment channels, filing taxes has become much more bearable, safer, and simpler to do these days.

As always, we hope that this guide will be able to help you in the process of filing your taxes and paying them online. If you have any questions or concerns, feel free to let us know in the comments section below!