Unemployment is a pressing issue that affects millions of individuals and families around the world. In the Philippines, the COVID-19 pandemic has exacerbated the problem, leaving many without work and struggling to make ends meet. Fortunately, the government has implemented various unemployment benefits programs to assist those in need.

Also Read: How to Become an OFW and Work Abroad

If you’re curious about what types of assistance are available for unemployed individuals in the Philippines, you’ve come to the right place. This article will explore the comprehensive list of unemployment benefits in the Philippines, including the qualifications, requirements, and application process for each program. Whether you’re currently unemployed or want to stay informed about the government’s efforts to support its citizens, this guide is a must-read.

The Philippines has long struggled with high levels of unemployment and underemployment, with the situation exacerbated by the COVID-19 pandemic. Prior to the pandemic, the unemployment rate was already hovering around 5-6%, with underemployment affecting an even greater number of workers. However, the pandemic has led to widespread job losses as businesses struggle to stay afloat, particularly in tourism, hospitality, and retail industries.

According to the Philippine Statistics Authority, the unemployment rate reached a record high of 17.7% in April 2020, with over 7 million Filipinos out of work. While the rate has since decreased, it remains significantly higher than pre-pandemic levels, with the most recent data showing a rate of 8.9% as of January 2022.

The unemployment situation in the Philippines has had serious implications for the country’s economy and society, particularly for those who have lost their livelihoods and are struggling to make ends meet. The government has implemented various measures to address the problem, including the implementation of unemployment benefits programs, but the road to recovery remains challenging.

Why this Matters to all Working Filipinos including OFWs

For all working Filipinos, including Overseas Filipino Workers (OFWs) and their families, it is important to know that until 2018, there were no specific unemployment benefits in the Philippines. However, in 2018, the Social Security Act was passed, which entitles unemployed private employees to receive unemployment insurance and benefits through the Social Security System. This includes monthly cash payments equal to 50% of their average salary, as long as they are under 60 years old, have paid at least 36 months of contributions, and are not already entitled to other, higher-paying benefits.

During the COVID-19 pandemic, unemployed workers were also entitled to payments of up to eight thousand pesos, provided that it did not prevent them from receiving the above-mentioned benefits. All working Filipinos and their families must be aware of these benefits, as they can help provide financial support during unemployment. It is also important to ensure that contributions to the Social Security System are made to qualify for these benefits.

Benefits for the Unemployed

Unemployment benefits in the Philippines are a form of financial assistance provided by the government to individuals who are currently without work. These benefits aim to help alleviate the financial burden of unemployment and provide a safety net for those who have lost their jobs.

The Philippine government offers two main sources of unemployment benefits: the Social Security System (SSS) and the Government Service Insurance System (GSIS). The SSS is a state-run social insurance program that provides a range of benefits, including unemployment insurance, to its members. Meanwhile, the GSIS is a similar program that covers employees in the public sector.

To qualify for unemployment benefits, individuals must meet certain eligibility requirements, such as having paid into the SSS or GSIS system for a certain period, being involuntarily separated from their job, and not being employed. The benefits received will depend on various factors, such as the individual’s earnings history and the duration of their unemployment.

Unemployment benefits support those struggling to find work in the Philippines. By providing financial assistance, the government aims to ease the burden of unemployment and help individuals recover.

Private sector – SSS

Key points:

- The Social Security Act of 2018 mandates the government to provide unemployment benefits to private sector employees who were involuntarily separated from employment.

- Unemployment benefit is also referred to as unemployment insurance or involuntary separation benefit.

- The benefits are dispensed through a one-time payment equal to 50% of the claimant’s monthly salary for a maximum of two months.

- To qualify, the claimant must have made 36 monthly contributions to the SSS, 12 of which should be in the 18-month period immediately preceding the month of involuntary separation.

- The benefit is also available for kasambahay (housemaids) as well as Overseas Filipino Workers (OFWs).

- Employees who were involuntarily separated due to specific reasons are not eligible for unemployment benefits.

- Claimants must be below a certain age at the time of separation, depending on their occupation.

- The benefit must be filed within one year from the date of separation.

The government provides unemployment benefits in the Philippines to private sector employees who were involuntarily separated from their employment. This benefit is also known as unemployment insurance or involuntary separation benefit, and the payments are sourced from the Social Security System (SSS). This benefit is not a loan and therefore, it does not incur any additional fees to the claimant.

Prior to the Social Security Act of 2018, there was no unemployment benefit scheme for private employees. The Social Security Act of 1954 had provisions related to unemployment benefits, but they were dropped in 1957 to prioritize retirement, sickness, disability, and death benefits.

Under the 2018 legislation, the benefits are dispensed through a one-time payment equal to 50% of the claimant’s monthly salary for a maximum of two months. To qualify, the claimant must have made 36 monthly contributions to the SSS, 12 of which should be in the 18-month period immediately preceding the month of involuntary separation. The benefit is also available for kasambahay (housemaids) as well as Overseas Filipino Workers (OFWs).

However, employees who were involuntarily separated due to willful disobedience to lawful orders, gross and habitual neglect of duties, fraud or willful breach of trust/loss of confidence, commission of a crime or offense, and other similar cases like abandonment, gross inefficiency, disloyalty/conflict of interest/dishonesty are not eligible for unemployment benefits.

Additionally, claimants must be below 60 years old at the time of separation, 50 years old or below if they are underground or surface mineworkers, and 55 years old or below if they are a racehorse jockey. It is also important to note that the benefit must be filed within one year from the date of separation.

To learn how to avail of the unemployment benefits via the SSS, you may refer to this guide.

How to claim SSS Unemployment Benefits

- SSS Unemployment Benefit payout can be received through different payment channels:

- SSS UMID card enrolled as an ATM

- Participating banks

- Electronic wallets like GCash and PayMaya

- Remittance transfer to cash payout outlets

- Make sure you have enrolled in at least one payment channel to receive your benefits in a timely manner

- File for SSS Unemployment Benefits once every three years, starting from the date of involuntary separation or termination

- Wait at least three years before filing again, should you become unemployed again in the future

- The SSS cannot provide two or more benefits simultaneously

- If you have filed for two or more compensable contingencies within the same compensable period, you will receive the highest one between the two

Public Sector – GSIS

Key points:

- Unemployment benefits for former government employees in the Philippines are provided by the Government Service Insurance System (GSIS).

- Eligible workers must have made 12 months of integrated contributions to the GSIS under Republic Act No. 8291.

- Payments are equal to 50% of the claimant’s average monthly compensation and are dispensed monthly for two to six months, depending on the claimant’s length of service.

- To qualify, individuals must have been involuntarily separated from their employment.

- Required documents and forms must be submitted to apply for unemployment benefits from the GSIS.

Suppose you are a former government employee in the Philippines who has been involuntarily separated from your job. In that case, you may be eligible for unemployment benefits from the Government Service Insurance System (GSIS).

To qualify, you must have made 12 months of integrated contributions to the GSIS under Republic Act No. 8291. If you meet this requirement, you can receive 50% of your average monthly compensation as payments for two to six months, depending on your length of service. These payments will be made every month.

It’s important to note that unemployment benefits are only available to those who have been involuntarily separated from their employment. If you resigned from your position or were terminated for cause, you may not be eligible for these benefits.

To apply for unemployment benefits from the GSIS, you will need to submit the necessary documents and forms, including your GSIS membership records and certification of involuntary separation from your former employer. You can find more information on the GSIS website or by contacting their customer service hotline.

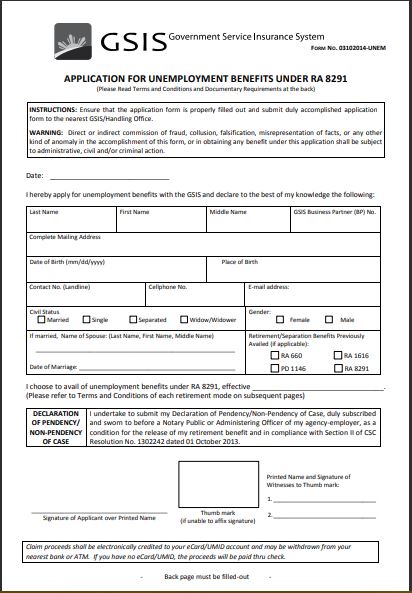

GSIS Unemployment Benefits Application Form (FORM NO. 03102014-UNEM)

The GSIS Unemployment Benefits Application Form (FORM NO. 03102014-UNEM) is a document that former government employees in the Philippines must fill out in order to apply for unemployment benefits from the GSIS. This form requires the applicant to provide personal information, employment history, and details on their involuntary separation from their job.

It also includes sections for the applicant’s signature and the signature of their former employer. The completed form must be submitted along with other required documents to the GSIS. To access this form and find more information on the application process, click this link.

How to claim GSIS Unemployment Benefits

If you’re a member of the Government Service Insurance System (GSIS) in the Philippines and have recently become unemployed, you may be eligible for unemployment benefits. Here’s a guide on how to claim your benefit:

- Download a Declaration of Pendency/Non-Pendency of Case from the GSIS website and have it notarized.

- Download and print the GSIS Application for Unemployment Benefits from the same website.

- Fill in all the necessary information on the application form.

- Submit the completed application form and Declaration of Pendency/Non-Pendency of Case to the nearest GSIS/Handling Office.

Once your application is approved, you will receive monthly cash payments equivalent to 50% of your average monthly compensation (AMC). The duration of the benefit depends on the length of your service and ranges from two months to a maximum of six months.

Here’s a breakdown of the benefit duration based on the length of your contributions:

- If your contributions have been made for a period of one year but less than three years, the benefit duration is for two (2) months.

- If your contributions have been made for a period of three or more years but less than six years, the benefit duration is for three (3) months.

- If your contributions have been made for a period of six years or more but less than nine years, the benefit duration is for four (4) months.Fina

- If your contributions have been made for a period of nine years or more but less than 11 years, the benefit duration is for five (5) months.

- If your contributions have been made for a period of 11 years or more but less than 15 years, the benefit duration is for six (6) months.

Tips when filing an application for benefits from the SSS or GSIS

For GSIS:

- Download the Touch mobile app or go to any of the 680 G-W@PS kiosks deployed nationwide.

- Use Touch app to view membership data, premium, and loans payments, service records, and membership service profiles.

- Members and pensioners can apply for loans, file life and retirement claims with tentative computations, and schedule APIR using the Touch app.

- If members do not have access to the Touch app, they can use the G-W@PS kiosks for services such as loan applications, online membership status query, UMID card activation, and annual renewal of pensioner’s active status.

- The G-W@PS system was upgraded in 2015 with added features such as the control center, which enables the central management of the system.

For SSS:

- Register online as a new member to obtain an SS number or update your personal data that require simple corrections.

- File your claim for retirement benefits, unemployment benefit insurance, the sickness benefit reimbursement for employers, maternity benefit, maternity benefit reimbursement for employers, and funeral benefits online.

- Apply for salary and calamity loans and renew pension loans online.

- Download the SSS Mobile App to apply for a salary loan, view contribution Payment Reference Number (PRN), pay for contributions using PayMaya, GCash, credit/debit cards, and BPI, view posted contribution payments, salary loan status and balance, and other services.

- Members and employers can access their SSS records using their mobile devices through the SSS Mobile App.

- Benefit claims are now released to the designated disbursement account of the SSS member or pensioner, whether it be through electronic wallets, cash payment outlets, PESONet, or the Union Bank of the Philippines (UnionBank) QuickCard.

- Access the ExpreSSS e-Learning (ExSSSeL) portal to learn about the SSS’s programs and updates, and the Customer Relationship Management System or uSSSap Tayo Portal to access all relevant information about products and services, including frequently asked questions about the SSS, and to lodge queries, concerns, or complaints.

- Activate your status using Zoom, Viber, Skype, and Facebook messenger to complete your online Annual Pensioners Information Revalidation (APIR) requirement to protect yourself from contracting the virus and ensure the continuous receipt of your pension.

Frequently Asked Questions

1. What are unemployment benefits in the Philippines?

Unemployment benefits are financial assistance provided by the Philippine government to eligible individuals who are involuntarily separated from their jobs.

2. Who can apply for unemployment benefits in the Philippines?

To be eligible for unemployment benefits in the Philippines, you must have been a member of the Social Security System (SSS) or the Government Service Insurance System (GSIS) and have made contributions for a certain period.

3. How long do I need to be a member of SSS/GSIS to qualify for unemployment benefits?

To qualify for unemployment benefits, you must have made at least 36 monthly contributions for SSS and at least 12 monthly contributions for GSIS.

4. How much can I receive from SSS unemployment benefits?

The amount of unemployment benefits you can receive from SSS depends on your average daily salary credit (ADSC). The minimum amount is Php 5,000 per month, while the maximum is Php 20,000 per month.

5. How much can I receive from GSIS unemployment benefits?

The amount of unemployment benefits you can receive from GSIS is equivalent to 50% of your average monthly compensation (AMC).

6. How long can I receive unemployment benefits in the Philippines?

The duration of unemployment benefits in the Philippines varies depending on the length of your contributions. For SSS, it can range from 2 to 6 months, while for GSIS, it can range from 2 to 6 months as well.

7. Can I receive SSS and GSIS unemployment benefits at the same time?

No, you cannot receive SSS and GSIS unemployment benefits at the same time. You can only receive one type of benefit at a time.

8. How can I apply for unemployment benefits in the Philippines?

You must submit the necessary documents and forms to the nearest SSS or GSIS office to apply for unemployment benefits. You can also apply online through their respective websites.

Video: SSS Unemployment Benefit || 2022 UPDATE || Bagong process ng pag-file ng UB || NEW PROCESS 2022

This video provides a detailed explanation of the SSS unemployment benefit, with a focus on changes that occurred during the pandemic from 2020 to 2022. The video aims to help those who are currently unemployed to determine whether they are eligible to claim this benefit. Additionally, the video highlights some of the factors that may disqualify an individual from receiving unemployment benefit.

Final Thoughts

In conclusion, unemployment is a serious issue that affects the lives of many people, especially during times of crisis like the COVID-19 pandemic. However, the Philippine government has made significant efforts to provide financial assistance to those in need through its comprehensive list of unemployment benefits programs. By understanding the qualifications, requirements, and application process for each program, unemployed individuals can take advantage of these benefits and ease the financial burden during difficult times. It’s essential to stay informed and aware of the resources available to help those in need, and this guide is an excellent starting point to do so.

READ NEXT: PhilHealth Benefits as an OFW