Overseas Filipino workers (OFWs) are celebrated as modern-day heroes in the Philippines, but despite the branding of being a “hero” for their contributions to the country’s economic well-being, what else is there for Filipino migrant workers?

Aside from the perks of having courtesy lanes for passport renewals, exclusive immigration and well-wishers booth, tax-free shopping at Duty Free and exclusive access to SM Global Pinoy Centers where they can enjoy free refreshments, free internet browsing, remittance pick-up, and free international calls, there are a few other fee exemptions that are made available to them.

No Need to Pay: List of FEES that OFWS are FREE from Paying

Here are some of the fee exemptions for OFWs:

- International Passenger Service charge (IPSC) or Terminal fee exemption

Terminal fee exemption was afforded to Overseas Filipino Workers (OFWs) the Memorandum of Agreement (MOA) between the Department of Transportation – Manila International Airport Authority (MIAA) and the 40 airline companies operating at the Ninoy Aquino International Airport (NAIA) was signed under the president’s directive.

Under the MOA, the terminal fee amounting to PHP550 shall be waived for OFWs, pilgrims, Philippine Sports Commission (PSC) delegates, and others authorized by law and the Office of the President to travel outside the Philippines. Exemption shall be honored upon face to face purchase of tickets and online purchases.

Transportation Secretary Art Tugade shared that President Rodrigo Duterte had said, “Regalo ko ito sa mga OFWs pagkat mahal ko sila,” upon the signing of the MOA.

- Travel Tax Documentary Stamp and Airport Fee exemption

The amendment to Republic Act No. 8042, also known as Migrant Workers and Overseas Filipinos Act, sees the signing of Republic Act 10022. Among the many inclusions of the amendment is an exemption for married or solo OFWs and their families, as found on Section 35 of the bill.

It reads,

SEC. 35. Exemption from Travel Tax Documentary Stamp and Airport Fee. – All laws to the contrary notwithstanding, the migrant workers shall be exempt from the payment of travel tax and airport-fee upon proper showing of proof entitlement by the POEA.

The remittances of all overseas Filipino workers, upon showing of the same proof of entitlement by the overseas Filipino worker’s beneficiary or recipient, shall be exempt from the payment of documentary stamp tax.

A substitute bill to House Bill 6138 was also signed ensuring that the families of OFWs get reductions in travel tax by extension. According to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA), taxes for first class flights for OFW families is only at Php400 instead of Php2700, while it is priced at Php300 instead of Php1620 for economy flights.

Those who are qualified for the privileged reduced travel tax rate are the following:

- Legitimate spouse of an OFW

- Unmarried children of an OFW whether legitimate or illegitimate who are below 21 years of age

- Children of OFWs with disabilities even before 21 years of age

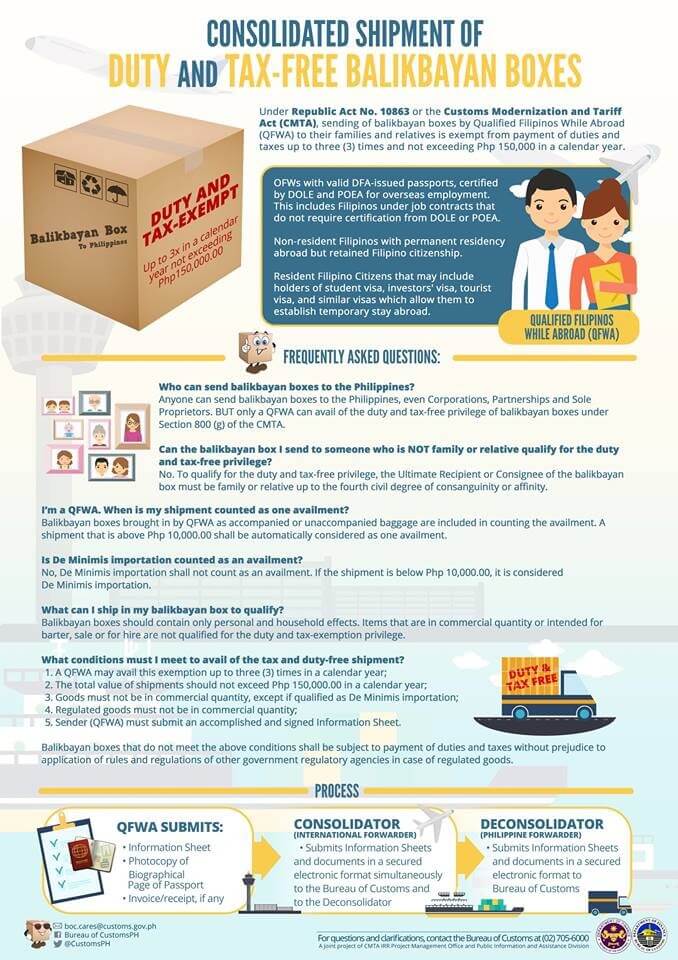

- Balikbayan box tax-exemption limit

With the value of tax-exemption limit for Balikbayan goods raised to Php150,000 from the original Php10,000, OFWs can now bring or send more goods to their loved ones in the Philippines tax-free. Senate Bill 2913, dubbed as the Balikbayan Box Law, cites what Senator Ralph Recto, proponent of the bill, call as Super Section 800 which reads, “conditional-free and duty-exempt importation.”

Several amendments to the bill eases the qualifiers for the privileged Filipino workers to be able to enjoy the higher tax exemption on their consolidated shipment of balikbayan boxes.

Instead of the mandatory copy of Philippine passport, other documents to show proof of Filipino citizenship are now accepted. The list of acceptable proof includes the following:

- pertinent page of the Philippine passport with personal information, picture and signature, or in case of dual Filipino citizen without Philippine passport, photocopy of foreign passport with personal information, picture and signature plus copy of proof of dual Filipino citizenship;

- permanent resident ID or equivalent document in other countries;

- Overseas Employment Certificate/OWWA Card;

- work permit;

- Unified Government ID issued by the Department of Labor and Employment;

- any other equivalent document except birth certificate.

- Temporary exemption of newly-hired OWs from immediately paying premium to the Social Security System (SSS)

In addition to these fee exemptions already in place for the OFWs to enjoy, DOLE is now pushing for temporary exemption of newly-hired OWs from immediately paying premium to the Social Security System (SSS).

Labor Secretary Silvestre H. Bello III is calling for the “modification” of the Implementing Rules and Regulation (IRR) of Republic Act (RA) 11199 or the Social Security Act. In his proposal, Bello is asking that the SSS premium for newly-hired OFWs be collected only three months after the worker is deployed in his or her country of destination. He also said that technically, these new hires have not yet received an Overseas Employment Certificate (OEC) and are therefore not yet considered OFWs and are not supposed to be subjected to mandatory SSS premium payment prior to OEC issuance.

“I already informed them of the legal contemplation: a worker, who has not been issued an OEC (overseas employment certificate) is not yet an OFW, and therefore cannot be covered by the compulsory coverage by the law,” Bello had said.

He added, “We will issue the OEC with the condition that three months after the worker has been deployed, we will start collecting his contribution. By that time, they are already earning could be considered and OFW [overseas Filipino workers].”