GCash is a popular mobile wallet app in the Philippines that offers a range of financial services, including GCash loans. These loans are available to GCash users through three different products: GLoan, GGives, and GCredit. Each product is designed to meet different borrowing needs, whether it’s for emergency expenses, small business capital, or personal loans.

In this guide, we’ll explore each of these products in more detail, including eligibility requirements, loan amounts, interest rates, and repayment terms. By the end of this blog, you’ll have a better understanding of GCash loans and be better equipped to decide which product is right for you. Keep on reading to learn more.

GCash loans are a convenient and accessible way for users of the GCash app to borrow money when they need it. With three loan products to choose from, users can find the right option to meet their specific financial needs, whether it’s for emergencies, personal expenses, or business capital. The loans are processed quickly, with approval times as short as 24 hours, and disbursements made directly to the user’s GCash wallet.

Additionally, the app’s digital platform makes it easy for users to manage their loans, including tracking payments and monitoring loan balances. With competitive interest rates and flexible repayment terms, GCash loan products provide a hassle-free and affordable way to access credit.

Why use GCash Loans?

GCash loans can be a useful option for individuals looking for a convenient and accessible way to access credit. Here are some reasons why you should consider using these loan products:

- Quick and easy application process: Applying for a GCash Loan is a simple and straightforward process that can be completed entirely through the app. The app also provides real-time updates on the status of your loan application, making the process transparent and efficient.

- Competitive interest rates: GCash loan products offer competitive interest rates compared to other loan options, making them an affordable way to access credit.

- Flexible repayment terms: With GCash loan products, borrowers have the option to choose repayment terms that fit their budget, ranging from one to six months. The app also provides a convenient repayment feature that automatically deducts payments from your GCash wallet on your scheduled due date.

- Variety of loan products: GCash offers three different loan products – GLoan, GGives, and GCredit – each tailored to meet different borrowing needs. This variety of options allows borrowers to choose the loan that best suits their needs.

- No collateral required: GCash loan products do not require any collateral or co-signers, making them accessible to individuals who may not have access to traditional credit options.

- Safe and secure: GCash is a trusted and secure platform that uses advanced encryption technology to protect user data and financial information.

GLoan

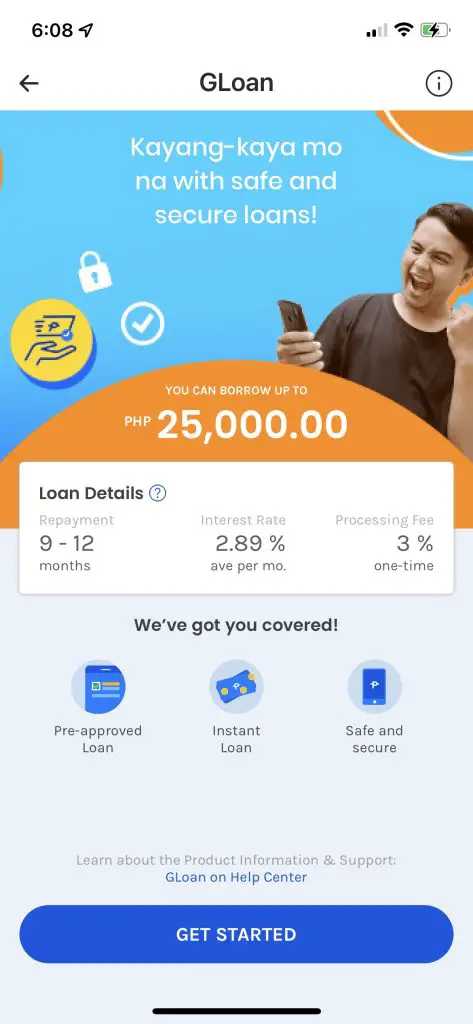

GLoan is a personal cash loan service that can be accessed directly through the GCash app. This guide will provide you with a step-by-step process on how to avail of GLoan, as well as important information about its interest rates, fees, eligibility requirements, and repayment options.

Eligibility Requirements for GLoan

Before availing of GLoan, it’s essential to check if you’re eligible for this service. The following qualifications are required to avail of GLoan:

- You must be a Filipino citizen aged 21 – 65 years old.

- You must be a fully-verified GCash user.

- You must have a high GScore, which is GCash’s trust rating that increases every time you use GCash’s features.

- You must have good credit standing and no fraudulent records.

Understanding GLoan Interest Rates and Fees

GLoan’s monthly interest rate differs for each user, but it ranges from 1.59% to 6.57%. Additionally, there’s a processing fee of 3% of the loaned amount, which is automatically deducted from the amount you’ll receive. For instance, if your loan of ₱5,000 is approved, ₱150 (5000 x 0.03) will be deducted from the loaned amount. This means that you’ll only receive ₱4,850 in your GCash wallet.

Late payment fees are also charged, with a fixed fee of ₱100, and a fixed amount equivalent to 0.15% of your outstanding principal balance for each day past due.

How to Avail of GLoan via GCash

Here’s a step-by-step guide on how to apply for GLoan:

- Open the GCash app and log in to your account.

- On the dashboard, select Borrow.

- Choose GLoan. Upon clicking this, you’ll see an overview of the applicable interest rate and processing fee. Tap Get Started to continue.

- Use the slider to enter your loan amount. Afterward, choose your loan duration and “Purpose of Loan” using the drop-down menu. Click Get this Loan to continue.

- Verify the loan details presented. Tap Continue to proceed.

- Review your personal information and tick “Agree” to the Data Privacy Policy Agreement. If you wish to update your info, tap “User Profile” at the bottom of the screen. Otherwise, click Next to continue.

- Review the loan details that are flashed again on the screen.

- Tick the checkboxes to agree to the Disclosure Statement and Loan’s Terms and Conditions. Click Continue to proceed.

- Tap Confirm once the app shows you the amount you’ll receive. Upon doing this, you’ll receive a six-digit authentication code via SMS.

- Enter the authentication code and tap Submit. A prompt will appear confirming your successful loan. You’ll receive an SMS within 24 hours once the amount is sent to your GCash wallet.

Repaying Your GLoan

You can repay your GLoan borrowed amount using your GCash e-wallet balance. If it’s not yet the due date of your loan, you can voluntarily repay your GLoan borrowed amount. Here are the steps to do so:

- Log in to your account.

- Tap Borrow on the dashboard.

- Tap GLoan.

- In the GLoan Dashboard, select Pay For GLoan.

- Enter the amount you want to repay and press Next.

- Review the details and select Pay. You’ll receive a payment receipt for your GLoan.

If it’s already the due date, GCash automatically deducts the amount from your e-wallet balance.

GGives

GGives is a unique feature of GCash that allows users to buy items from any GCash partner merchant and pay for it in installments ranging from 3 to 12 months. In this guide, we will explore the details of GGives, including eligibility, loanable amount, interest rates, and repayment. We will also discuss how to register and use GGives for online and QR code purchases.

Eligibility for GGives

To be eligible for GGives, you need to have a fully-verified GCash account, a high GScore, and be between 21 to 65 years old. You must also have a good credit standing and no records of fraudulent activity. The required GScore to avail of GGives may vary for every GCash user, and there’s no single GScore level that unlocks GGives.

Loanable Amount and Interest Rates

The loanable amount for GGives is between ₱1,000-₱50,000, which will be directly paid to the GGives partner merchant where you purchased the item. The interest rate for GGives ranges from 0% to 4.99%, depending on your GScore and loan term. As of this writing, there is no processing fee for GGives.

Using GGives for Purchases

GGives can be used for purchases made from any of the 85,000 partner merchants nationwide, including supermarkets, convenience stores, gasoline stations, and pharmacies. You can use GGives for online purchases made through shopping platforms like Shopee and Lazada or by paying with QR codes at partner merchants.

How to Register and Use GGives

- To register for GGives, simply login to your GCash account, select Borrow, and tap GGives.

- Double-check your personal information, agree to the Fuse Lending policies, and hit the Activate my GGives button to finish.

- To use GGives, select Pay QR or GCash as your payment option and choose GGives as your preferred installment option.

- You can repay your GGives balance automatically through GCash or choose to pay in advance through the app.

GCredit

GCredit is a credit line offered by GCash, a mobile wallet app in the Philippines. In this guide, we’ll take a closer look at how GCredit works, its eligibility requirements, borrowing limits, and interest rates.

How Does GCredit Work?

GCredit is a credit line that allows users to borrow money to pay for in-store and online transactions with over 17,500 GCredit Partner Merchants nationwide. It works like a regular credit card, but without the need for a physical card. Instead, users can access GCredit through the GCash app, making it a more convenient option for those who don’t want to apply for a traditional credit card.

No Documents Required

One of the advantages of GCredit is that there is no need to prepare any documents or go to a bank to apply. Users can simply apply through the app and start using GCredit with just a few taps on their phone.

Repayment Terms

GCredit borrowers have up to 45 days to pay the borrowed amount from the transaction. Late payments are charged with a penalty fee, starting at ₱200 for payments 1-30 days overdue.

Interest Rates and Fees

The interest rate for GCredit varies based on the user’s GScore, with rates ranging from 1% to 7%. Users can check their effective interest rate on their GCredit Dashboard screen. As of this writing, GCredit has no processing fee but charges a penalty fee for late payments.

Eligibility Requirements

To be eligible for GCredit, users must be Filipino citizens between the ages of 21 and 65, have a fully-verified GCash account, have a high GScore, and have no fraudulent records.

Borrowing Limits

The initial credit limit for GCredit is ₱1,000, but users can increase their limit up to ₱30,000 based on their GScore.

How to Register for GCredit

- To register for GCredit, go to your dashboard and select “GCredit.”

- Users who are qualified can unlock this feature and proceed to verify their email address and complete their information.

- After submitting an application, users will receive an update via SMS or email within 1-3 days.

Video: Paano Umutang Gamit GCash | GCash Financing Products You Should Check Out!

In this video, we will be taking a closer look at three of GCash’s most useful features: GCredit, GLoan, and GGives. As a GCash user, the vlogger shares her personal experience with these products and features, including actual screenshots from her account.

The video delves deeper into how each feature works, its advantages, and how to use it. The vlogger explains how GCredit, a credit line from GCash, can be used as a payment option for in-store and online transactions, just like a regular credit card, but without the need for a physical card. She also talks about GLoan, which offers a quick and hassle-free way to borrow money for personal or business use, and GGives, which allows users to donate to various causes and organizations.

Frequently Asked Questions

1. What is GCash Loan?

GCash Loan is a feature offered by GCash that provides users with quick and easy access to credit, allowing them to borrow money for various purposes.

2. What types of loans does GCash offer?

GCash offers three types of loans: GLoan, GGives, and GCredit. GLoan is a personal loan that can be used for various expenses, while GGives is a donation platform that enables users to donate to various causes. GCredit, on the other hand, is a credit line that can be used for in-store and online transactions.

3. How can I apply for a GCash Loan?

To apply for a GCash Loan, simply log in to your GCash account, select the loan product you want to apply for, and follow the on-screen instructions. Depending on the loan product, you may need to provide additional documentation and undergo a credit assessment.

4. What are the eligibility requirements for GCash loan products?

To be eligible for a GCash Loan, you must be a Filipino citizen between 21 and 65 years old, have a fully-verified GCash account, and meet the specific requirements for each loan product.

5. What is the interest rate for GCash loan products?

The interest rate for GCash loans varies depending on the loan product and your creditworthiness. For GCredit, for example, the interest rate ranges from 1% to 7% per month.

6. How much can I borrow with GCash loan products?

The amount you can borrow with GCash loan products varies depending on the loan product and your creditworthiness. The initial credit limit for GCredit, for example, is ₱1,000, but it can go up to ₱30,000.

7. What are the fees associated with GCash loan products?

The fees associated with GCash loans vary depending on the loan product. GCredit, for example, has no processing fee but charges a penalty fee for late payments.

8. How do I repay my GCash Loan?

You can repay your GCash Loan through the GCash app using your GCash wallet. Simply go to the loan product’s page and select the option to repay. You can also set up automatic repayment to ensure that you never miss a payment.

Summary

GCash loans offer a convenient and accessible way for Filipinos to borrow money using their mobile phones. With GLoan, GGives, and GCredit, GCash users have a variety of loan products to choose from depending on their borrowing needs.

By providing quick approval, low interest rates, and flexible repayment terms, GCash loan products have become a popular option for those who need financial assistance. If you’re a GCash user and need to borrow money, consider exploring these loan products to see if they’re the right fit for you.

READ NEXT: How to Transfer Money from GCash Wallet to Philippine Banks