Banks are generally known for monetary transactions. However, these institutions also provide auxiliary services for remittances and investments. Among the many services these banks provide is the safety deposit box – a facility that allows safekeeping of valuables in a secure facility outside of your own home.

Also Read: List of Philippine Bank Codes & SWIFT, BIC, and Routing Numbers

In case you want to know what are the banks that are offer a safety deposit box feature, we have gathered a list for your reference.

What is a safety deposit box?

A safety deposit box is an individual locker of sorts, usually a metal box that is resistant to fire, flood, heat, earthquakes, hurricanes, explosions, and other disastrous conditions, and is typically secured in a vaulted section of a bank. It comes in various sizes, more for protection from natural disasters and theft than insurance.

It is further secured with double locks and two keys and requires authorization in the case of another person accessing it on your behalf (except in cases of joint rentals). It usually comes with size restrictions and limited access, however, so you might want to keep anything that you might need in emergency situations out of this box.

What are the things that you can put in a safety deposit box?

The Philippine Deposit Insurance Corporation (PDIC) don’t insure these boxes, mainly because the bank are not privy to the content of the boxes, or their value. However, banks have rules that may limit the things that go into these boxes, like the rule against keeping explosives and illegal stuff in the box you are renting.

“It basically comes down to what the bank has got in their lease agreement that you signed and agreed to,”says Dave McGuinn, president and founder of Safe Deposit Specialists.

The rule of thumb when deciding what to put into a safe-deposit box is if the following statement applies:

“If these <item name> were lost, I’ll be in big trouble.”

To help you, here is a list of things that you can and should keep in a safe deposit box:

- Copy of your will

- Copy of insurance policies

- Titles to your house and cars

- Detailed list of bank and brokerage accounts, CDs and credit cards

- Marriage license / Divorce decree

- Expensive, rarely-worn jewelry

- Birth certificates

- Family heirlooms

- Stock and bond certificates

Other things that you can put in include the following:

- Antiques

- Stamp or coin collections

- Rare collectibles

So, what should not be stored in a safety deposit box?

Anything you might need in an emergency, in case your bank is closed for the night, the weekend or a holiday. Examples would be items like:

- originals of a “power of attorney” (your written authorization for another person to transact business on your behalf)

- passports (in case of an emergency trip),

- medical-care directives if you become ill and incapacitated

- funeral or burial instructions you make.

Which banks offer this service in the Philippines? We have listed them below with their corresponding fees.

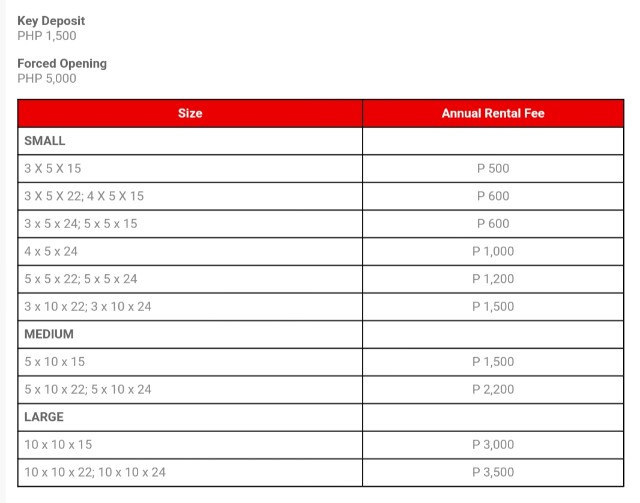

1. China Bank

Safety Deposit Box (SDB) Rental Fees: Php 500.00 to Php 3500.00

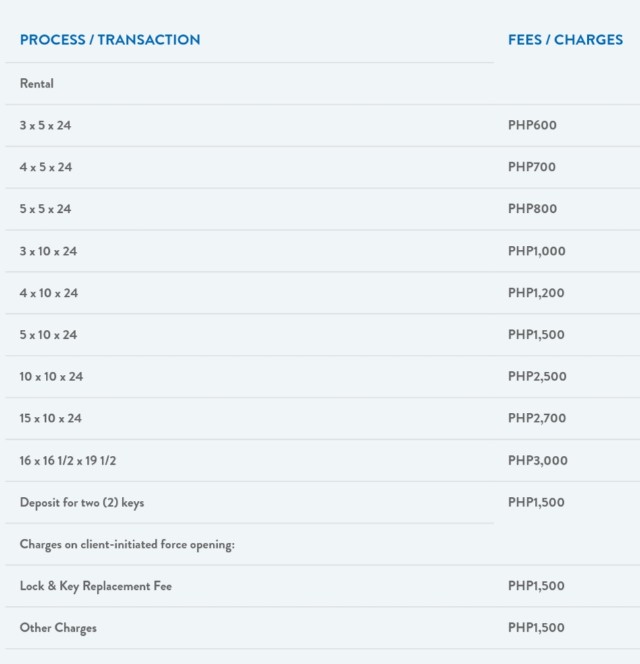

2. Security Bank

Safety Deposit Box (SDB) Rental Fees: Php 600.00 to Php 1500.00

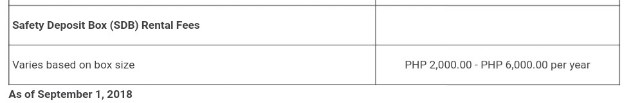

3. Bank of the Philippine Islands (BPI)

Safety Deposit Box (SDB) Rental Fees: Php 2000.00 to Php 6000.00

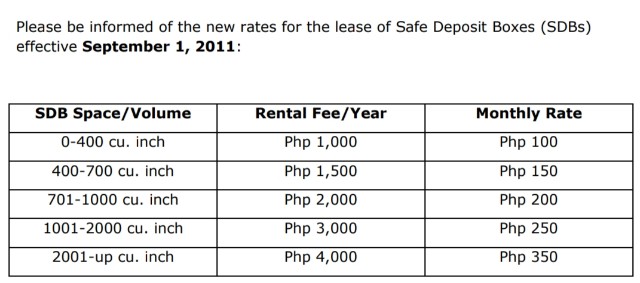

4. Philippine National Bank (PNB)

Safety Deposit Box (SDB) Rental Fees: Php 1000.00 to Php 4000.00

Our tip: It is not always easy to secure a box. For major or popular banks, it might merit a long wait for vacancy, so you might want to pick a branch away from higher net worth residential areas or avoid those that are easily accessible.