Every year, the Social Security System (SSS) issues a table and schedule of fees that shows how much members (employees and employers) need to pay for contributions every month. This is also an important tool used by companies in determining the amounts to be deducted from employees’ salaries per cut-off. Please be guided by the information below with the updated amount of contribution per month for every member and the schedule of payments this year 2025.

The amount and the deadlines of payment vary depending on your income situation so you need to understand which category you belong and send your contributions as per your status.

Also Read: How to Check SSS Contributions via SMS Text

This SSS table can be used by individual members when checking their contributions posted online. Moreover, we can refer to the table’s monthly salary credit (MSC) based on our salary bracket, to determine the loans and benefits that we can avail of from SSS.

Monthly SSS Contribution Table 2025 & Payment Schedule

Every month, members pay their contributions voluntarily or through the company they work for. Basically, monthly contributions are computed based on the salary bracket to which a member is categorized. It also depends on whether you are Employed, Self-Employed, a Voluntary Member, a Non-Working Spouse, or an Overseas Filipino Worker (OFW).

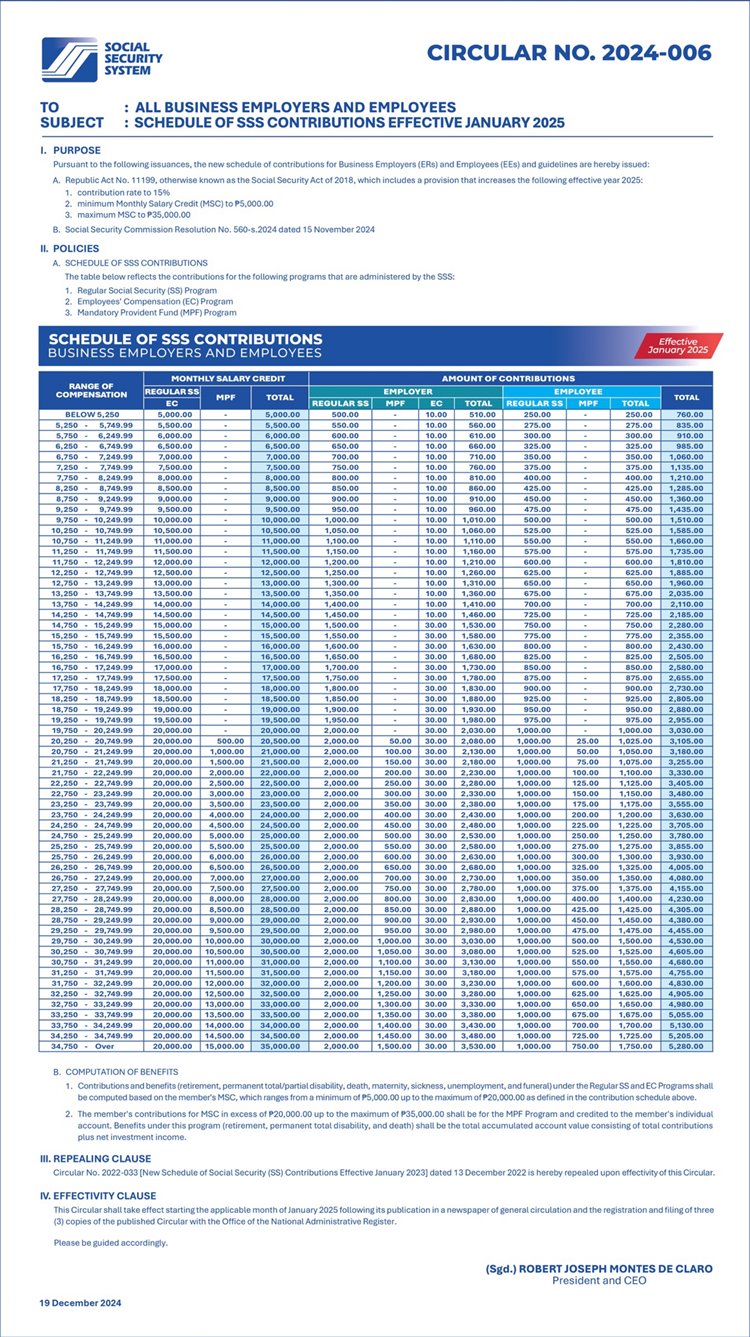

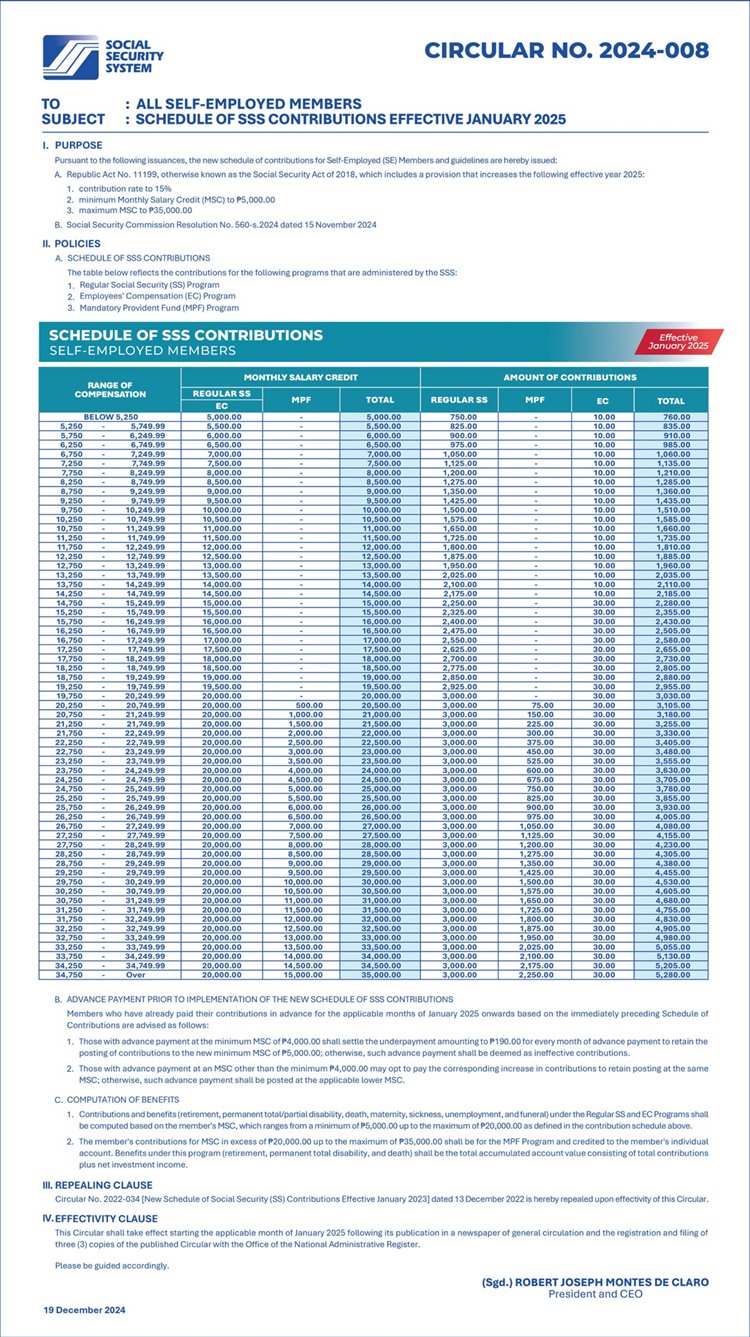

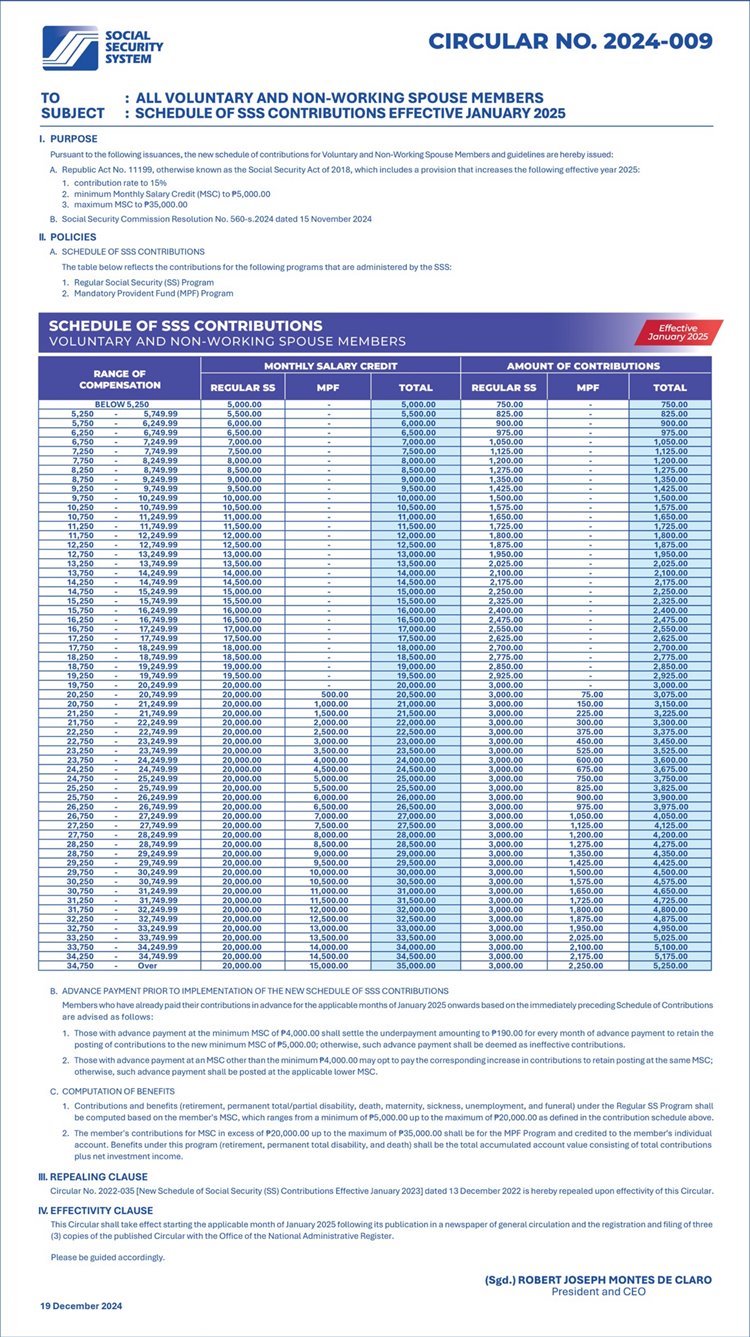

There is a new circular issued where it contains a new SSS contribution table which is valid starting from January 2025. Please be informed of this update where there is a price increase from the previous payments.

Be advised of these recent circulars issued by SSS regarding the new monthly contribution amounts:

Check the Excel table sheet below for the Range of Compensation, Monthly Salary Credit, and Amount of Contributions:

| Gross Salary Range | Monthly Salary Credit | Regular Contribution | WISP/ Mandatory Provident | Total for Remittance | |||||||||||

| FROM | TO | REG/EC | WISP | TOTAL | ER1 | EE1 | Total | EC | MPF-ER | MPF-EE | TOTAL | SSS EE Share | SSS ECC | SSS ER Share | TOTAL2 |

| Below 5,250 | 5,000.00 | – | 5,000.00 | 500.000 | 250.000 | 750.000 | 10.00 | – | – | – | 250.00 | 10.00 | 500.00 | 760.00 | |

| 5,250.00 | 5,749.99 | 5,500.00 | – | 5,500.00 | 550.000 | 275.000 | 825.000 | 10.00 | – | – | – | 275.00 | 10.00 | 550.00 | 835.00 |

| 5,750.00 | 6,249.99 | 6,000.00 | – | 6,000.00 | 600.000 | 300.000 | 900.000 | 10.00 | – | – | – | 300.00 | 10.00 | 600.00 | 910.00 |

| 6,250.00 | 6,749.99 | 6,500.00 | – | 6,500.00 | 650.000 | 325.000 | 975.000 | 10.00 | – | – | – | 325.00 | 10.00 | 650.00 | 985.00 |

| 6,750.00 | 7,249.99 | 7,000.00 | – | 7,000.00 | 700.000 | 350.000 | 1,050.000 | 10.00 | – | – | – | 350.00 | 10.00 | 700.00 | 1,060.00 |

| 7,250.00 | 7,749.99 | 7,500.00 | – | 7,500.00 | 750.000 | 375.000 | 1,125.000 | 10.00 | – | – | – | 375.00 | 10.00 | 750.00 | 1,135.00 |

| 7,750.00 | 8,249.99 | 8,000.00 | – | 8,000.00 | 800.000 | 400.000 | 1,200.000 | 10.00 | – | – | – | 400.00 | 10.00 | 800.00 | 1,210.00 |

| 8,250.00 | 8,749.99 | 8,500.00 | – | 8,500.00 | 850.000 | 425.000 | 1,275.000 | 10.00 | – | – | – | 425.00 | 10.00 | 850.00 | 1,285.00 |

| 8,750.00 | 9,249.99 | 9,000.00 | – | 9,000.00 | 900.000 | 450.000 | 1,350.000 | 10.00 | – | – | – | 450.00 | 10.00 | 900.00 | 1,360.00 |

| 9,250.00 | 9,749.99 | 9,500.00 | – | 9,500.00 | 950.000 | 475.000 | 1,425.000 | 10.00 | – | – | – | 475.00 | 10.00 | 950.00 | 1,435.00 |

| 9,750.00 | 10,249.99 | 10,000.00 | – | 10,000.00 | 1,000.000 | 500.000 | 1,500.000 | 10.00 | – | – | – | 500.00 | 10.00 | 1,000.00 | 1,510.00 |

| 10,250.00 | 10,749.99 | 10,500.00 | – | 10,500.00 | 1,050.000 | 525.000 | 1,575.000 | 10.00 | – | – | – | 525.00 | 10.00 | 1,050.00 | 1,585.00 |

| 10,750.00 | 11,249.99 | 11,000.00 | – | 11,000.00 | 1,100.000 | 550.000 | 1,650.000 | 10.00 | – | – | – | 550.00 | 10.00 | 1,100.00 | 1,660.00 |

| 11,250.00 | 11,749.99 | 11,500.00 | – | 11,500.00 | 1,150.000 | 575.000 | 1,725.000 | 10.00 | – | – | – | 575.00 | 10.00 | 1,150.00 | 1,735.00 |

| 11,750.00 | 12,249.99 | 12,000.00 | – | 12,000.00 | 1,200.000 | 600.000 | 1,800.000 | 10.00 | – | – | – | 600.00 | 10.00 | 1,200.00 | 1,810.00 |

| 12,250.00 | 12,749.99 | 12,500.00 | – | 12,500.00 | 1,250.000 | 625.000 | 1,875.000 | 10.00 | – | – | – | 625.00 | 10.00 | 1,250.00 | 1,885.00 |

| 12,750.00 | 13,249.99 | 13,000.00 | – | 13,000.00 | 1,300.000 | 650.000 | 1,950.000 | 10.00 | – | – | – | 650.00 | 10.00 | 1,300.00 | 1,960.00 |

| 13,250.00 | 13,749.99 | 13,500.00 | – | 13,500.00 | 1,350.000 | 675.000 | 2,025.000 | 10.00 | – | – | – | 675.00 | 10.00 | 1,350.00 | 2,035.00 |

| 13,750.00 | 14,249.99 | 14,000.00 | – | 14,000.00 | 1,400.000 | 700.000 | 2,100.000 | 10.00 | – | – | – | 700.00 | 10.00 | 1,400.00 | 2,110.00 |

| 14,250.00 | 14,749.99 | 14,500.00 | – | 14,500.00 | 1,450.000 | 725.000 | 2,175.000 | 10.00 | – | – | – | 725.00 | 10.00 | 1,450.00 | 2,185.00 |

| 14,750.00 | 15,249.99 | 15,000.00 | – | 15,000.00 | 1,500.000 | 750.000 | 2,250.000 | 30.00 | – | – | – | 750.00 | 30.00 | 1,500.00 | 2,280.00 |

| 15,250.00 | 15,749.99 | 15,500.00 | – | 15,500.00 | 1,550.000 | 775.000 | 2,325.000 | 30.00 | – | – | – | 775.00 | 30.00 | 1,550.00 | 2,355.00 |

| 15,750.00 | 16,249.99 | 16,000.00 | – | 16,000.00 | 1,600.000 | 800.000 | 2,400.000 | 30.00 | – | – | – | 800.00 | 30.00 | 1,600.00 | 2,430.00 |

| 16,250.00 | 16,749.99 | 16,500.00 | – | 16,500.00 | 1,650.000 | 825.000 | 2,475.000 | 30.00 | – | – | – | 825.00 | 30.00 | 1,650.00 | 2,505.00 |

| 16,750.00 | 17,249.99 | 17,000.00 | – | 17,000.00 | 1,700.000 | 850.000 | 2,550.000 | 30.00 | – | – | – | 850.00 | 30.00 | 1,700.00 | 2,580.00 |

| 17,250.00 | 17,749.99 | 17,500.00 | – | 17,500.00 | 1,750.000 | 875.000 | 2,625.000 | 30.00 | – | – | – | 875.00 | 30.00 | 1,750.00 | 2,655.00 |

| 17,750.00 | 18,249.99 | 18,000.00 | – | 18,000.00 | 1,800.000 | 900.000 | 2,700.000 | 30.00 | – | – | – | 900.00 | 30.00 | 1,800.00 | 2,730.00 |

| 18,250.00 | 18,749.99 | 18,500.00 | – | 18,500.00 | 1,850.000 | 925.000 | 2,775.000 | 30.00 | – | – | – | 925.00 | 30.00 | 1,850.00 | 2,805.00 |

| 18,750.00 | 19,249.99 | 19,000.00 | – | 19,000.00 | 1,900.000 | 950.000 | 2,850.000 | 30.00 | – | – | – | 950.00 | 30.00 | 1,900.00 | 2,880.00 |

| 19,250.00 | 19,749.99 | 19,500.00 | – | 19,500.00 | 1,950.000 | 975.000 | 2,925.000 | 30.00 | – | – | – | 975.00 | 30.00 | 1,950.00 | 2,955.00 |

| 19,750.00 | 20,249.99 | 20,000.00 | – | 20,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | – | – | – | 1,000.00 | 30.00 | 2,000.00 | 3,030.00 |

| 20,250.00 | 20,749.99 | 20,000.00 | 500.00 | 20,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 50.00 | 25.00 | 75.00 | 1,025.00 | 30.00 | 2,050.00 | 3,105.00 |

| 20,750.00 | 21,249.99 | 20,000.00 | 1,000.00 | 21,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 100.00 | 50.00 | 150.00 | 1,050.00 | 30.00 | 2,100.00 | 3,180.00 |

| 21,250.00 | 21,749.99 | 20,000.00 | 1,500.00 | 21,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 150.00 | 75.00 | 225.00 | 1,075.00 | 30.00 | 2,150.00 | 3,255.00 |

| 21,750.00 | 22,249.99 | 20,000.00 | 2,000.00 | 22,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 200.00 | 100.00 | 300.00 | 1,100.00 | 30.00 | 2,200.00 | 3,330.00 |

| 22,250.00 | 22,749.99 | 20,000.00 | 2,500.00 | 22,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 250.00 | 125.00 | 375.00 | 1,125.00 | 30.00 | 2,250.00 | 3,405.00 |

| 22,750.00 | 23,249.99 | 20,000.00 | 3,000.00 | 23,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 300.00 | 150.00 | 450.00 | 1,150.00 | 30.00 | 2,300.00 | 3,480.00 |

| 23,250.00 | 23,749.99 | 20,000.00 | 3,500.00 | 23,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 350.00 | 175.00 | 525.00 | 1,175.00 | 30.00 | 2,350.00 | 3,555.00 |

| 23,750.00 | 24,249.99 | 20,000.00 | 4,000.00 | 24,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 400.00 | 200.00 | 600.00 | 1,200.00 | 30.00 | 2,400.00 | 3,630.00 |

| 24,250.00 | 24,749.99 | 20,000.00 | 4,500.00 | 24,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 450.00 | 225.00 | 675.00 | 1,225.00 | 30.00 | 2,450.00 | 3,705.00 |

| 24,750.00 | 25,249.99 | 20,000.00 | 5,000.00 | 25,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 500.00 | 250.00 | 750.00 | 1,250.00 | 30.00 | 2,500.00 | 3,780.00 |

| 25,250.00 | 25,749.99 | 20,000.00 | 5,500.00 | 25,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 550.00 | 275.00 | 825.00 | 1,275.00 | 30.00 | 2,550.00 | 3,855.00 |

| 25,750.00 | 26,249.99 | 20,000.00 | 6,000.00 | 26,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 600.00 | 300.00 | 900.00 | 1,300.00 | 30.00 | 2,600.00 | 3,930.00 |

| 26,250.00 | 26,749.99 | 20,000.00 | 6,500.00 | 26,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 650.00 | 325.00 | 975.00 | 1,325.00 | 30.00 | 2,650.00 | 4,005.00 |

| 26,750.00 | 27,249.99 | 20,000.00 | 7,000.00 | 27,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 700.00 | 350.00 | 1,050.00 | 1,350.00 | 30.00 | 2,700.00 | 4,080.00 |

| 27,250.00 | 27,749.99 | 20,000.00 | 7,500.00 | 27,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 750.00 | 375.00 | 1,125.00 | 1,375.00 | 30.00 | 2,750.00 | 4,155.00 |

| 27,750.00 | 28,249.99 | 20,000.00 | 8,000.00 | 28,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 800.00 | 400.00 | 1,200.00 | 1,400.00 | 30.00 | 2,800.00 | 4,230.00 |

| 28,250.00 | 28,749.99 | 20,000.00 | 8,500.00 | 28,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 850.00 | 425.00 | 1,275.00 | 1,425.00 | 30.00 | 2,850.00 | 4,305.00 |

| 28,750.00 | 29,249.99 | 20,000.00 | 9,000.00 | 29,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 900.00 | 450.00 | 1,350.00 | 1,450.00 | 30.00 | 2,900.00 | 4,380.00 |

| 29,250.00 | 29,749.99 | 20,000.00 | 9,500.00 | 29,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 950.00 | 475.00 | 1,425.00 | 1,475.00 | 30.00 | 2,950.00 | 4,455.00 |

| 29,750.00 | 30,249.99 | 20,000.00 | 10,000.00 | 30,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 1,000.00 | 500.00 | 1,500.00 | 1,500.00 | 30.00 | 3,000.00 | 4,530.00 |

| 30,250.00 | 30,749.99 | 20,000.00 | 10,500.00 | 30,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 1,050.00 | 525.00 | 1,575.00 | 1,525.00 | 30.00 | 3,050.00 | 4,605.00 |

| 30,750.00 | 31,249.99 | 20,000.00 | 11,000.00 | 31,000.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 1,100.00 | 550.00 | 1,650.00 | 1,550.00 | 30.00 | 3,100.00 | 4,680.00 |

| 31,250.00 | 31,749.99 | 20,000.00 | 11,500.00 | 31,500.00 | 2,000.000 | 1,000.000 | 3,000.000 | 30.00 | 1,150.00 | 575.00 | 1,725.00 | 1,575.00 | 30.00 | 3,150.00 | 4,755.00 |

| 31,750.00 | 32,249.99 | 20,000.00 | 12,000.00 | 32,000.00 | 2,000.00 | 1,000.00 | 3,000.00 | 30.00 | 1,200.00 | 600.00 | 1,800.00 | 1,600.00 | 30.00 | 3,200.00 | 4,830.00 |

| 32,250.00 | 32,749.99 | 20,000.00 | 12,500.00 | 32,500.00 | 2,000.00 | 1,000.00 | 3,000.00 | 30.00 | 1,250.00 | 625.00 | 1,875.00 | 1,625.00 | 30.00 | 3,250.00 | 4,905.00 |

| 32,750.00 | 33,249.99 | 20,000.00 | 13,000.00 | 33,000.00 | 2,000.00 | 1,000.00 | 3,000.00 | 30.00 | 1,300.00 | 650.00 | 1,950.00 | 1,650.00 | 30.00 | 3,300.00 | 4,980.00 |

| 33,250.00 | 33,749.99 | 20,000.00 | 13,500.00 | 33,500.00 | 2,000.00 | 1,000.00 | 3,000.00 | 30.00 | 1,350.00 | 675.00 | 2,025.00 | 1,675.00 | 30.00 | 3,350.00 | 5,055.00 |

| 33,750.00 | 34,249.99 | 20,000.00 | 14,000.00 | 34,000.00 | 2,000.00 | 1,000.00 | 3,000.00 | 30.00 | 1,400.00 | 700.00 | 2,100.00 | 1,700.00 | 30.00 | 3,400.00 | 5,130.00 |

| 34,250.00 | 34,749.99 | 20,000.00 | 14,500.00 | 34,500.00 | 2,000.00 | 1,000.00 | 3,000.00 | 30.00 | 1,450.00 | 725.00 | 2,175.00 | 1,725.00 | 30.00 | 3,450.00 | 5,205.00 |

| 34,750.00 | 20,000.00 | 15,000.00 | 35,000.00 | 2,000.00 | 1,000.00 | 3,000.00 | 30.00 | 1,500.00 | 750.00 | 2,250.00 | 1,750.00 | 30.00 | 3,500.00 | 5,280.00 | |

2025 SSS Contribution Table for Regular Employers and Employees

Below are the SSS monthly table of contributions schedule starting January 2025 for regular members/employees.

For Employed Members, the minimum monthly salary credit is PHP 5,000, with a total contribution of PHP 760.00, while the maximum monthly salary credit is PHP 20,000, with a total contribution of PHP 5280.00.

2025 SSS Monthly Contribution Table for Self-Employed Members

Below is the SSS monthly table of contributions schedule starting January 2025 for Self-Employed members:

For Self-Employed, the minimum and maximum total monthly contributions are PHP 760.00 and PHP 5280.00, respectively.

2025 SSS Monthly Contribution Table for Voluntary Members and Spouses

Below is the SSS monthly table of contributions schedule starting January 2025 for Voluntary Members and non-working spouses:

For Voluntary Members/Non-Working Spouses, the minimum and maximum total monthly contributions are PHP 750.00 and PHP 5250.00, respectively.

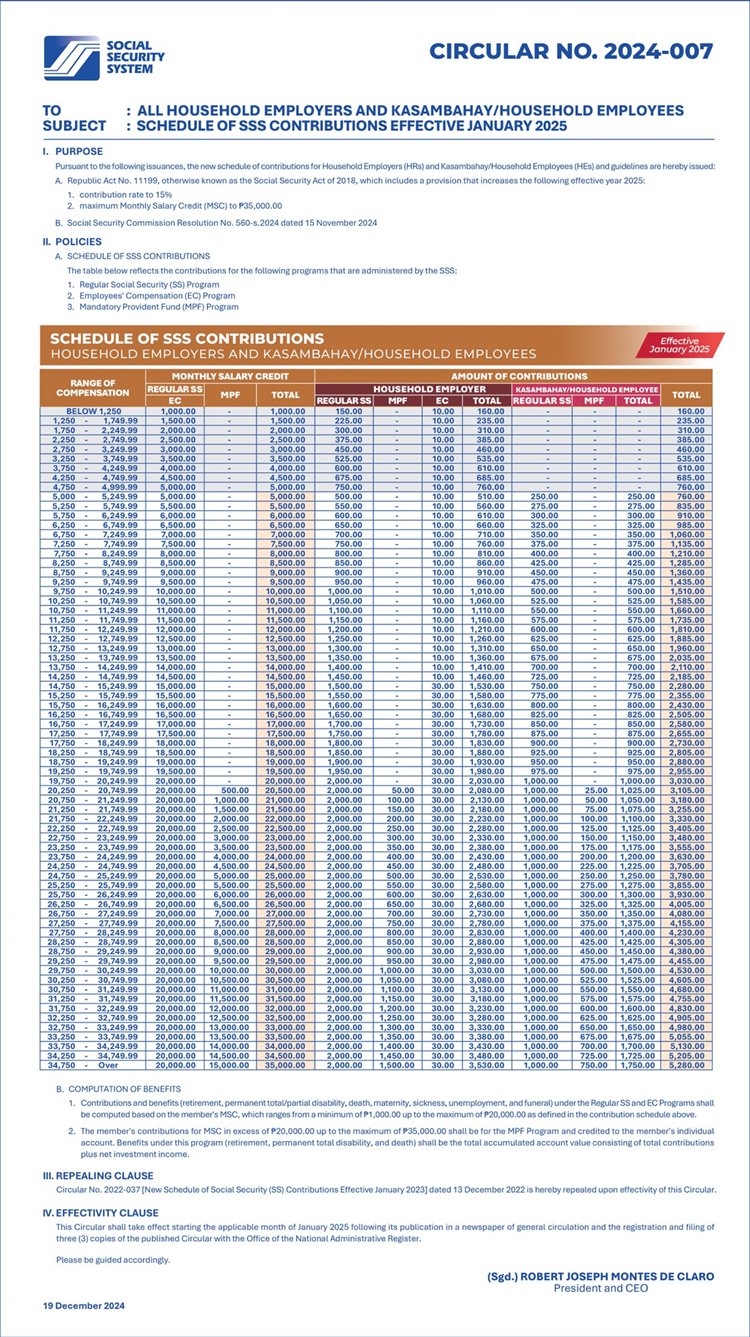

2025 SSS Monthly Contribution for Household Employers and Domestic Helpers

Below is the SSS monthly table of contributions schedule starting January 2025 for household employees:

For Household Employers and Household Service Workers, the minimum and maximum total monthly contributions are PHP 150.00 and PHP 5280.00, respectively.

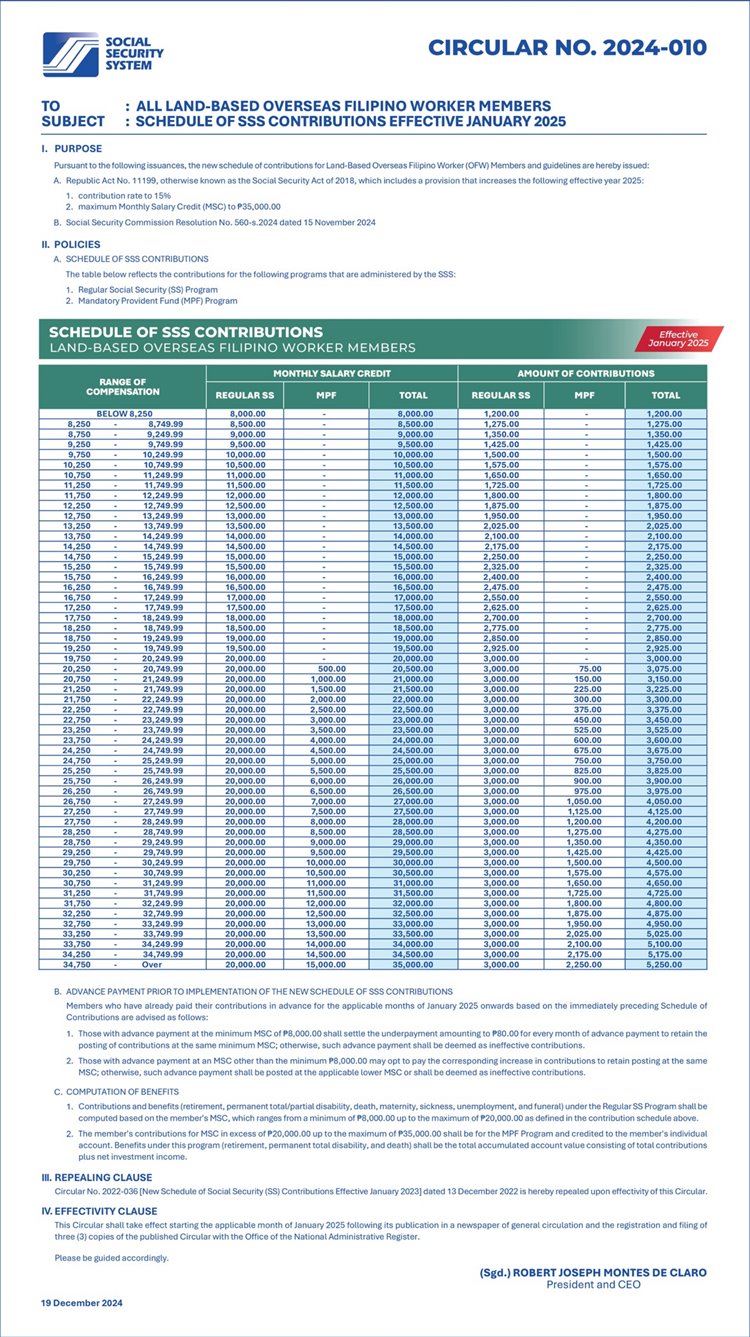

2025 SSS Contribution Table for Overseas Filipino Workers (OFWs)

Meanwhile, below is the new SSS Contribution Table for OFW Members, indicating that the minimum monthly salary credit is PHP 8250.00. Please take note of the difference between land-based OFWs in countries that have bilateral labor agreements with the Philippines, along with sea-based OFWS, as compared to land-based OFWs in countries without bilateral labor agreements.

For sea-based OFWs and land-based OFWs in countries with bilateral labor agreements, the minimum total contribution is PHP 1200.00, whereas the maximum contribution is PHP 5250.00 per month.

Payment Schedule for All SSS members (Employee & Employers)

There are also updates in terms of the schedule when you should pay, whether you are a regular employee or you want to pay voluntarily. Please make sure that you are aware of the dates and deadlines because it is only for special cases (like OFWs) that you are able to backtrack your payment, but even so, there is still a last day for you to backtrack your contributions.

As for the payment schedule, the deadline for paying monthly contributions remain as follows:

- Regular Employers – last day of the month following the applicable month

- Household Employers – last day of the month following the applicable month or calendar quarter

- Self-Employed, Voluntary and Non-Working Spouse Members – last day of the month following the applicable month or calendar quarter

- OFW Members – January to September – until December 31 of the applicable year, October to December – until January 31 of the following year

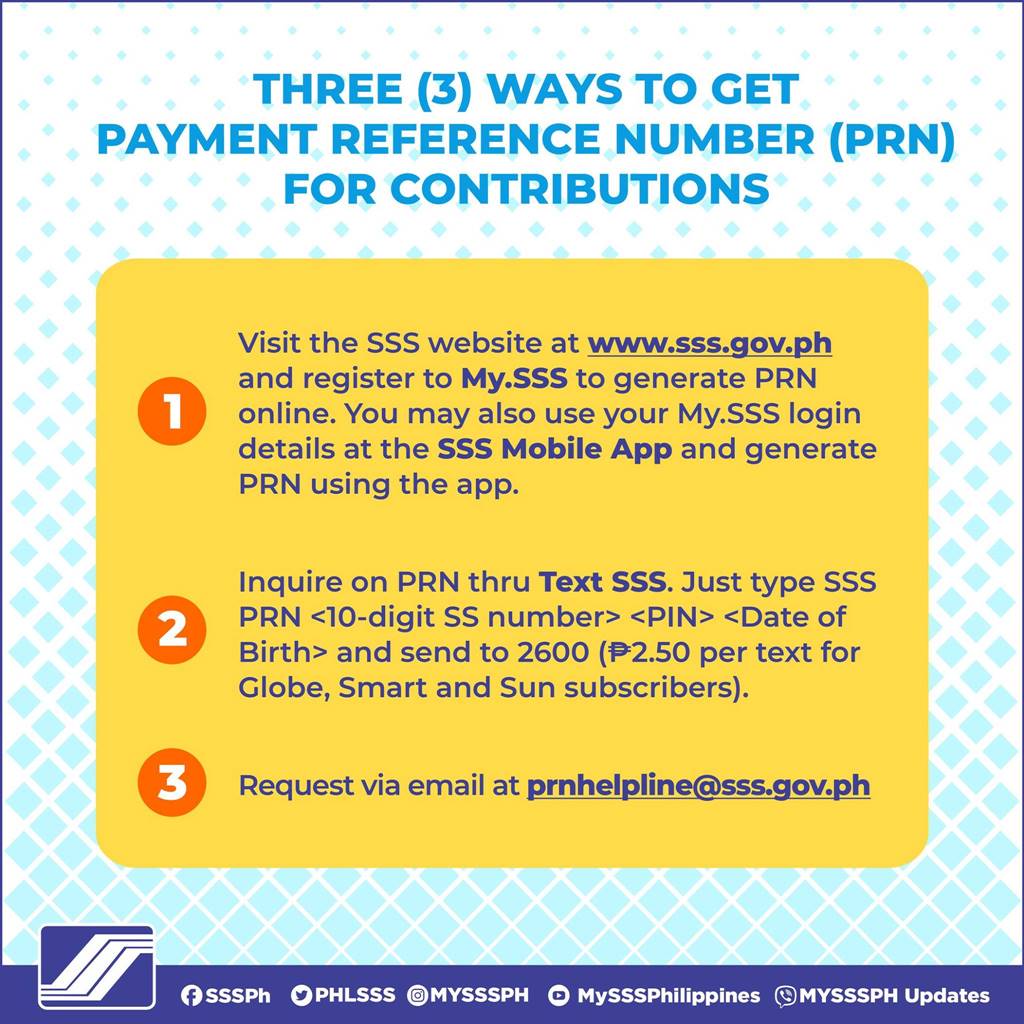

3 Ways to Get your SSS Payment Reference Number (PRN) for the Contributions

- Visit the SSS website at www.sss.gov.ph and register to My.SSS to generate PRN online. You may also use your My.SSS login details at the SSS Mobile App and generate using the app.

- Inquire on PRN thru Text SSS. Just type SSS PRN <10-digit SS number> <PIN> <Date of Birth> and send to 2600 (Php2.50 per text for Globe, Smart and Sun subscribers).

- Requeste via email at prnhelpline@sss.gov.ph

Video: SSS 2025 Payment Contributions

Below is a video showcasing the monthly of member contributions. Check it out:

Important Reminders

For Employed Members: Take note of the payment deadlines for member contributions and loans (if any) to avoid incurring penalties. Employee members should also check if their employers are paying for their monthly contributions and member loans, based on the prescribed schedule of payments as shown above. Late payments will result in penalties and delays in the processing/approval of member benefits, as well as loans.

For Voluntary or Self-Employed Members: Settle your payments following the above schedule. However, you can decide on the frequency terms of settling your payments – either on a monthly or quarterly basis. A quarter covers three calendar months that end on the last day of March, June, September, and December. Payment for one, two or all months in a quarter is accepted.

For OFWs: You may settle your payment for the months of January to December of any given year within the same year. Contributions for the months of October to December of a given year may also be settled on or before January 31st of the following year.

Dates for Settlement of Loan Payments: Member loans are to be settled on a monthly basis, in reference to the prescribed schedule of payments as shown above.

The establishment of state-owned funds like the SSS aims to provide financial support, assistance, and security for eligible Filipino citizens through the many services and benefits they offer. Therefore, as private working individuals, we are eligible to be part of the national fund system, and it is our responsibility to settle our dues accordingly so that we can take advantage of the benefits and services that the SSS offers.

ALSO READ: How to Get an SSS Payment Reference Number (PRN)

Summary

Please do not ever forget to keep contributing to your SSS membership as this will help you in the long run. If you may feel that the amount of your pension may not be enough when you retire, it is still a lot better to have something to receive every month compared to not having anything at all. It is wise to invest in our future because it is not all the time that we are young and able. Better learn to use our money and put them to good use.

Also, try to put off money for savings because we don’t know what the future holds for us. Let us all learn to have proper financial education and make sure that we do not easily let our emotions get the better of us especially when it comes to shopping and purchasing unnecessary items.

We hope you find the SSS table and tips above as your main source of reference when you want to know how much you need to pay if you want to continue paying for your Social Security System benefits.

Also Read: How to Find Lost or Forgotten SSS Number