Did you know that you can apply for a TIN (tax identification number) even if you’re not employed at the moment? That’s good news for newly grads and even those who’ve been laid off and those repatriated during the pandemic – but are actively looking for jobs.

In this guide, we will share the steps on how you can get this government-issued information as easily and conveniently as possible. Make sure to read until the end of this guide.

Applying For TIN Even Without A Job? Here’s How:

Contrary to what some people believe, you’re supposed to get your TIN BEFORE you start working.

This is very important since it will give you a head start in securing a job and other government-issued IDs or documents. Also, your TIN will be used for various purposes. It is your proof of being a taxpayer. It will be used when you transact with government agencies and establishments. In this guide, we will share the steps on how you can apply for one even if you are currently unemployed.

What is a TIN?

The Tax Identification Number is a unique set of numbers that are used to identify taxpayers. It’s issued by the Bureau of Internal Revenue.

Even if they’re not entitled to it, Filipinos are still obliged to get their TIN. The following sections will discuss how to get it for the unemployed.

Getting the Tax Identification Number is a requirement for everyone who wants to start a business or employment. This is not only for the individuals who are already employed because even students can file to obtain one.

Every individual is supposed to only have one unique TIN in their entire lifetime.

Uses of TIN

The TIN number is a unique identification number that enables you to transact with government offices and private establishments, including the following:

- Apply for Driver’s License at Land Transport Office

- Apply for NBI Clearance

- Apply for Passport at the Department of Foreign Affairs

- Apply for scholarships

- Open a bank account

How Can Unemployed Individuals Apply For a TIN?

Getting a TIN in 2021 for the unemployed has been made simple. This procedure is very easy to do since it’s carried out through Executive Order 98, allowing one to transact with the government in offices such as NBI, LTO, DFA, and so forth.

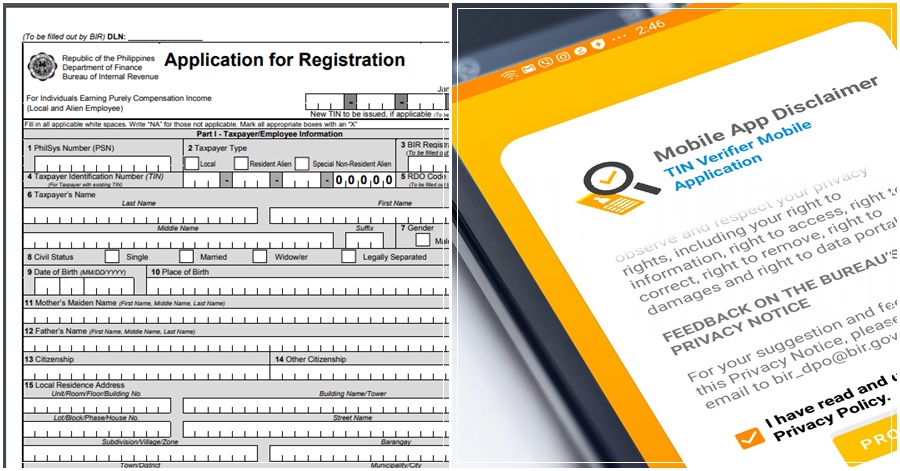

Individuals who are required to provide a Taxpayer ID (TIN) for transactions with the government can now get their TINs. For this purpose, BIR Form 1904 became very useful for people who are unemployed. It allowed them to get the TIN even if they are not working.

Requirements

To get a TIN, you need to have the following requirements on hand:

- BIR Form 1904

- Birth certificate or any government-issued document

- Marriage certificate (if married); and

- Passport for foreign nationals

Steps On Applying For A Tax Identification Number (TIN):

Here is how you can apply for a TIN as an unemployed individual in the Philippines:

- Pay a visit to the Revenue District Office in charge of your present address or home.

- Make a duplicate copy of the BIR Form 1904 after filling it out.

- Submit the form to the person in charge of the office, together with the needed documentation.

- Wait for the issuing of your TIN ID, which will include your Tax Identification number.

TIN is a paper-based document that is issued without charge. It does not come with a photo. You will need to attach a 1 x 1 passport-sized photo and then laminate it to preserve your document.

How To Get a TIN Online

Through the internet, Filipinos can get their tax ID number online. This type of document is used to identify individuals who file tax returns.

Through BIR eReg, Filipinos can easily register for tax services without going to a branch office of the Bureau of Internal Revenue.

The following are some of the most important characteristics of this web application system:

- Issuance of TIN online

- Payment of registration fees

- Generation of the Certificate of Registration

Unfortunately, the TIN system is temporarily unavailable. If you need to get TIN, you may go ahead and visit the nearest branch of the BIR.

Frequently Asked Questions

- Who is obliged to register with the Bureau of Internal Revenue (BIR)?

Everyone who is liable to an internal revenue tax must register with the relevant Revenue District Officer at least once, including:

- Within ten (10) days after starting a new job, or

- On or before the start of the business day, or

- prior to the payment of any owed taxes, or

- When a return, statement, or declaration is filed as required by the NIRC.

- Individual’s death;

- Settlement of the estate’s tax liabilities in full;

- The identification of a taxpayer with several TINs; and

- A legal person’s dissolution, merger, or consolidation.

- Is it necessary for non-resident aliens and non-resident foreign entities who get revenue from the Philippines to register with the BIR?

Non-Resident Aliens (NRAs) who are not engaged in trade or business in the Philippines may be issued TINs for the purposes of withholding taxes from the country.

The withholding agent shall submit the TIN in the name of the NRFC or the NRANETB as an applicant under EO 98, which is aimed at preventing double taxation.

- Is a taxpayer need to register if he engages in VATable activity but his total sales or receipts from business or practice of the profession are less than P 3,000,000.00?

If his gross sales or receipts for the year exceed P 100,000.00, he may register as a non-VAT taxpayer. However, in the case of marginal income earners, they may not have the same option.

- Is it necessary for taxpayers to register their businesses on a yearly basis?

No, taxpayers only need to register once before they start doing business. They must, however, pay a registration cost of P 500.00 per year.

- When must a taxpayer file a registration application and pay the registration fee?

Taxpayers should apply for registration before they start their business. They should pay the registration fee once a year.

Final Thoughts

Getting your TIN number for the unemployed has never been that easy. In fact, the steps mentioned above would help you get it fast and easily. Doing business with the government requires the TIN document. It is a must-have for every transaction.

READ NEXT: How to Register for BIR Tax as an Online Freelancer in the Philippines