Back in September 3, the Philippine Social Security System (SSS) introduced the SSS Pension Loan Program (PLP), which aims to extend more affordable loan benefits for paying members that meet the set criteria by the SSS for the Pension Loan Program (PLP).

With the new loan program being rolled out, SSS pensioners no longer have to resort to money-lending firms (which could even be scammers) and/or loan sharks for (typically) immediate financial expenses, such as medical costs, household overheads, and other unforeseen events. Don’t our retired kababayans deserve just that?

Steps to Apply for the SSS Pension Loan Program

Since its launch in September, the state fund has already released around PHP 49.8 million in pension loans to almost 2,000 pensioners who applied for the PLP, according to a report by the Philippine Inquirer.

As per SSS president and chief executive officer Emmmanuel F. Dooc, the agency has received a significant number of applicants in just 12 days after the PLP was launched in select branches.

ALSO READ: SSS Mobile App Now Available for Download

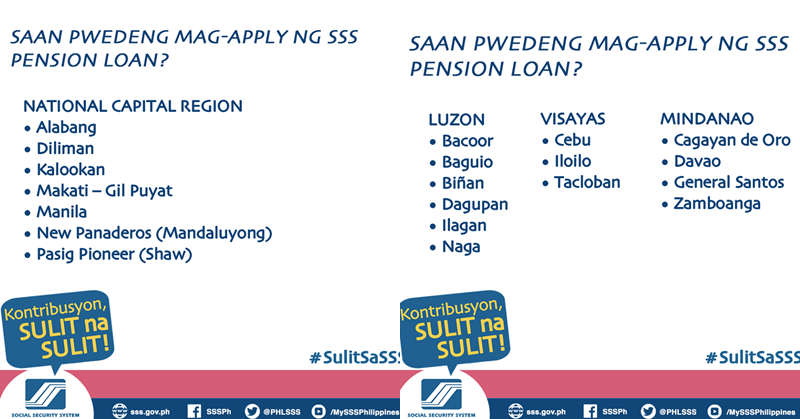

From the 34 branches that initially offered the PLP, 50 additional branches – 14 in Metro Manila and 36 in various parts of the country, also began to offer the loan program on September 19 and 24, respectively. Here are the branches that offer the PLP, as shared on the SSS Facebook Page:

Who are eligible to apply for the Loan Program?

Based on the announcement shared by the SSS regarding the PLP last September 3, those who are eligible to avail the program are limited to SSS member-pensioners who:

- Are 80 years of age and below by the end of the loan term;

- Do not have any outstanding loan balance and benefit overpayment with the SSS;

- Did not apply for advanced pension under SSS Calamity Benefit; and

- Have been receiving their monthly pension from SSS in the last six months.

What are the Loan Requirements and how do we apply?

Considering the above qualifications, member-pensioners must take the following steps set by the state fund:

- Visit any of the authorized SSS branches and personally provide a copy of ANY of the following valid IDs:

- SSS ID

- Unified Multi-purpose ID Card (UMID)

- Valid passport

- Two (2) other valid government picture IDs bearing identical signatures of the member-pensioner.

- Obtain the cash card (quick card) of your preferred bank where your loaned amount will be processed and deposited to.

Note: You may enrol your UMID card as an ATM card at any service branch or kiosk of the Union Bank of the Philippines only.

- Select the loan amount and loan term you would like to apply for.

- Check the information and details of your loan shown on the screen.

- Affix your signature on the Pension Loan Assistance Application and Disclosure Statement Form and click submit.

You will be asked to wait for up to five (5) banking days from the loan approval date for the fund to be credited to your UMID card or cash card of your bank of choice.

To get more updates about the Pension Loan Program of the SSS, you may check their Facebook page or official website, or call their member hotline at 02-920-6446 to 55. Alternatively, you may also send them an email via member_relations@sss.gov.ph.