The GSIS Financial Assistance Loan is a program that provides financial assistance to qualified GSIS members who have dependent children enrolled in college. GSIS Members who apply for the this program can get up to PHP 500,000 as cash assistance spread out in 5 years (PHP100,000 for every school year).

The GSIS Education Loan is commonly referred to as the GFAL-EL, or a study now, pay later scheme by the agency to aid its members with children going to college.

With this, you can get a loan from the GSIS to pay for your child’s college tuition. However, there are some important things you should know about the GSIS Education Loan before you apply for one. Keep on reading to learn more.

GSIS Education Loan Features

The maximum amount that can be availed of by a student for a five-year course through the GSIS Education Loan is Php 100,000.00 for each school year for up to 5 years.

The GSIS Education Loan program provides a ten-year term and an 8% interest rate. This facility is unique because it allows borrowers to have a grace period of five years; thus, the repayment period starts on the sixth year of the loan.

Note: GFAL-EL stands for GSIS Financial Assistance Loan – Educational Loan

Qualifications

In order to avail of the GSIS Education Loan, you have to meet the following requirements:

- The GSIS member must be an active member for at least 15 years. He/she may nominate not more than two (2) beneficiaries of the loan.

- The student-beneficiaries must be:

- Filipino citizen;

- Relative of the member-borrower;

- Enrolled in an undergraduate course with a maximum study period of five years; and

- Agrees to become the co-maker on loan once reached the legal age.

Requirements

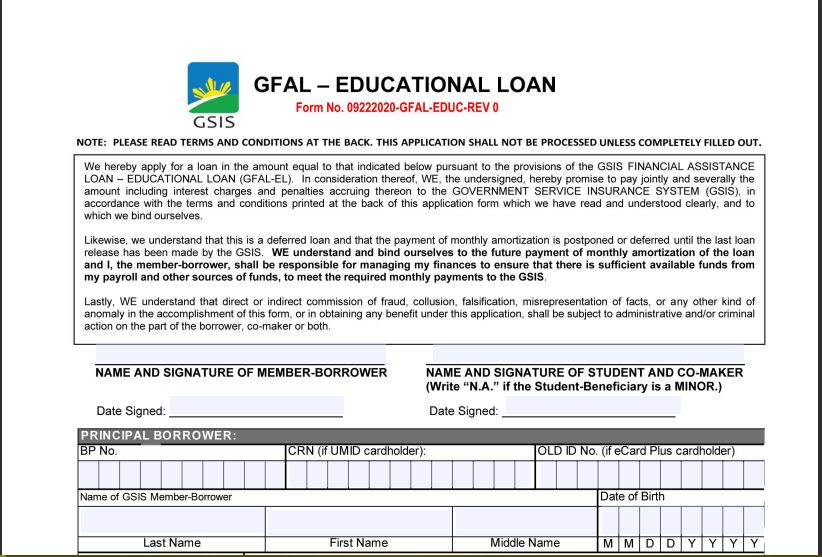

- Education Loan Application Form;

- Tuition Assessment Form or Enrollment Form; and

- Copy of School ID with three signatures of the student on the same page or any ID bearing the birth date, picture, and signature

How to Apply for the GSIS Education Loan Program?

- Download the application form and accomplish it completely.

- Prepare scanned or photocopies of all the required documents.

- Submit the requirements through the following methods:

-

- eGSISMO

- dropbox

- The GSIS Handling Branch Employee shall contact you for:

-

- Tentative loan computation; and

- Loan Counselling Session.

How to Pay Back the GSIS Education Loan

Repayment terms for the GFAL-EL program are the same as those for ordinary loan repayment. GSIS will deduct your monthly installment from your salary or pension. You can also opt to pay the loan through one of the following methods:

– Automatic deduction from your bank account every month

– In-person payments at any GSIS branch

Loan Repayment Online via Partner Banks

– GSIS members can pay for their service loans through the UnionBank Online App.

1. To log in, download the app via Apple or Google Play Store and enter the one-time PIN (OTP) sent to your mobile number.

2. After you have logged in, select “GSIS Service Loans” and the “Type of Loan”.

3. Input the details of the borrower’s GSIS Business Partner number. These include their last name, mobile number, email address, and amount to be paid then click the “PAY” button.

4. An email and SMS confirmation will be sent to the email address and mobile number provided by the payor.

– GSIS members can also pay for their service loans through their LandBank Online Account.

IMPORTANT: LandBank accountholders must be enrolled in LandBank’s iAccess.

1. Once you have been enrolled in LandBank’s iAccess, go to the Landbank Link.BizPortal at https://www.lbpeservices.com/ egps/portal/index.jsp.

2. Select “Government Service Insurance System” and the “Loan Payment” type.

3. Enter the “Amount Due”, “BP Number”, “Last Name”, “Mobile Number” and other transaction details then click “CONTINUE”.

4. Select “LANDBANK” as “Payment Mode” and enter their mobile number through which the OTP authorizing the transaction will be sent.

5. Input the OTP and click submit to confirm payment.

Loan Repayment through Bayad Centers

GSIS members can now pay for their service loans through Bayad’s payment touchpoints. This service was previously only available to Bayad Center members.

To pay, go to the nearest Bayad Center and fill out a Bayad Form with your full name, business partner (BP) number, loan type, payment amount and date, and mobile number.

– The validated Bayad Form will serve as proof of payment, and you may view your payments through your eGSISMO accounts.

6 Benefits of the GFAL – Education Loan

Eligible GSIS members can take advantage of the GFAL – Education Loan to pay for their child’s college education. Here are some of its benefits:

1. Easy Application process

The GSIS-EL allows you to apply for your child’s college education without the need for collateral. It is also easy to apply and approval is only a matter of time.

2. Study-now, Pay-later

The GFAL – Education Loan allows you to defer payment of your college expenses until after your child has graduated. This means that you do not have to worry about meeting monthly obligations as long as your child is still enrolled in school.

3. Low interest rate of 8% p.a.

The GSIS-EL has a low interest rate of 8% p.a., making it easier for you to pay off your loan and avoid getting into debt. It is also fixed, which means that you do not have to worry about interest rates increasing any time soon.

4. 10-year loan program, but payment only starts in the sixth year.

The GSIS-EL is a ten-year loan program, but payment only starts in the sixth year. This means that you do not have to worry about paying for your child’s college education right away. You can take your time and save up some money before starting your monthly payments.

5. The beneficiary can help repay the loan after they graduate from any four- or five-year course.

Since loan payment will only take effect in the sixth year of the grant, students who are willing to help pay off their college loan can work as soon as they graduate in any four- or five-year course. The GSIS-EL is also a low-interest-rate loan, which means that you will not have to pay much money in interest after graduation. This is great because it will not cost you more than you can afford to pay.

6. Government-insured loan

Another benefit of the GSIS-EL is that it is government-insured, which means that you will not have to worry about losing your money if you cannot pay back the loan. In fact, if you die or become disabled before repaying your loan, the government will repay it for you. This is great because it means that even if something happens to you, there will still be someone else who can pay off your college debt.

Frequently Asked Questions

Here are some of the frequently asked questions about the GSIS Education Loan Program:

1. What is the GSIS Financial Assistance Loan – Educational Loan (GFAL-EL)?

GFAL-EL is an educational loan program offered by GSIS to its members to pay for the tuition fees and other school expenses of their child or relatives. This loan program is based on the concept of “study now, pay later” and gives the borrower a grace period to save up for the loan payment.

2. Who and how many are qualified to be student-beneficiaries in GFAL-EL?

- Up to two (2) relatives of the borrower can be student-beneficiaries. They should be:

- Filipinos based in the Philippines;

- A relative of member-borrower to the third degree of consanguinity;

- Enrolled in a four or five-year college degree in private or public university or college; and

- Willing to be co-maker of loans when it comes to the age of majority (18 Years Old)

3. Does AAO need to certify their loan application before the GSIS processes it?

Yes, the AAO must provide certification that members possess the qualification needed. In addition, the AAO should also include the following in the certification:

- Reduce the monthly amortization of borrowers on their salary;

- If the borrower is leaving the service, any benefit will not be released to him or her until the agency gets and shows the clearance from GSIS.

4. When and how will the GFAL-EL be released?

GSIS will initially give a letter of guarantee to speed up enrollment and allow qualified students to attend their school. The GSIS will send a check directly to the beneficiary’s college or university every semester, tri-semester, or quad-semester.

5. How much is the interest, and how long is the GFAL-EL payment term?

The interest rate on a loan is 8%, computed in advance, and its term is ten years. During the first five years of the loan, no monthly amortization is paid. If the student completes a four-year program, the first amortisation payment will begin one year after the final semester.

It can be paid for up to five years. For a five-year course, there won’t be a one-year grace period; their payments will start immediately after the last semester and can be paid up to five years.

6. What will happen if the member-borrower cannot make a payment?

When the borrower is unable to pay six months of amortization or more, the outstanding balance of the loan will be due and demandable. Your outstanding loan balance will be deducted from any future benefit you may avail of from the GSIS. Moreover, the agency can chase nominated student-beneficiaries as automatic co-makers to pay.

7. What if the member- or student-borrower dies or becomes disabled within the loan term?

Because GFAL-EL is covered by loan redemption insurance, the loan will be considered fully paid if the member-borrower or

Student-beneficiary dies or has a permanent total disability within the study period, the loan will also be considered fully paid if you die or have a permanent total disability if the loan repayment is up-to-date.

8. Can the GSIS cancel a loan?

Yes, the GSIS may cancel future loan payments in the case of:

- Death, resignation or retirement, sustaining a permanent disability, or once the member-borrower has been dismissed from the service while the student-beneficiary is still studying. However, if the study period has already ended at the time of the member-borrower’s death or when they sustained a permanent disability, the loan will be treated as fully paid if the loan payment is up to date.

- There was misrepresentation on the member-borrower’s side about their loan (for example, they said the relative student-beneficiary was not truly related to them), the loan will be considered due and demandable.

- Member-beneficiary was unable to enroll because of non-meritorious reasons such as dropping out, suspension or expulsion. The loan will be considered due and demandable.

Video: GFAL – Education Loan

In response to former President Duterte’s call for financial support for the education of the country’s students, the government’s pension fund announced that it would provide a total of 20 billion pesos in loans for students.

According to GSIS President and General Manager Rolando Ledesma Macasaet, members of the government’s pension fund, who have at least 15 years of service, will be able to avail of a loan for their children’s education. However, they will not have to pay for the first five years.

One of the programs that the government is offering is the GFAL-EL, which allows students to borrow up to 100,000 pesos for tuition and other school fees, with an interest rate of only 8%.

The GSIS member can also nominate two student-beneficiaries for the program. These individuals must be related to the members of the organization and are enrolled in a public or private university or college.

The proceeds of the loan will be used to fund the education of the beneficiaries. They will be paid directly to the school through the student’s account.

Individuals with at least 15 years of service can also apply for the loan. They should not have a criminal background or administrative case, and they should not be on leave without pay.

They should also meet the required monthly take-home pay of at least 5,000 pesos. Their agencies should not be on suspension.

The loan will also be insured, which means that it will be paid in case the borrower or the student dies or gets permanently or totally disabled.

Final Thoughts

GSIS members can now avail of educational loans for their families or relatives. This is a great opportunity for them to pursue their dreams and at the same time, build their future. While the program certainly has its advantages, members must also be aware of the risks involved. They should take into account their financial situation before applying for a loan and consider other options if they can’t afford it. Despite this, the GSIS has made it a point to offer members with lower income a chance to pursue their educational dreams. It’s also important for them to remember that the loan is just one of many options available in helping you achieve your goals.

We hope that you have found this article useful, and we encourage you to share it with your friends and family. If you want to learn more about the GSIS Program or find out how it can help you achieve your dreams, please visit the official GSIS website.

Disclaimer: This post is intended for informational purposes only. If you wish to learn more about the GSIS Education Program or how it can help you achieve your dreams, please visit the official GSIS website.

READ NEXT: Government Service Insurance System (GSIS): What You Need to Know