Did you know that as an OFW, you can apply for a direct housing loan from SSS? Here’s a guide on how to do it! As an Overseas Filipino Worker, it’s important that you are able to continue your SSS contributions as you may benefit greatly from these when you retire.

Also Read: 7 Benefits as a Member of SSS

The Direct Housing Loan program for OFWs is designed to help provide OFWs an option to avail a low-cost housing scheme. In this article, we will guide you on how you can request for a housing loan from SSS.

Overseas Filipino Workers can Apply for Direct Housing Loans from SSS

Good news for our kababayans abroad: Getting your dream house is now made simple and affordable through the SSS Direct Housing Loan Facility for OFWs.

Who are Eligible for this Program?

OFW members who meet the following criteria are eligible to avail this service:

- A certified OFW and is a voluntary member of the SSS

- Has had at least 36 months contributions and 24 continuous contributions prior to the application

- Must not be above 60 years of age at the time of application and must be insurable

Note: Members aged 60 at the time of application will have a maximum of five (5) loan term years.

- Must not be previously granted a housing loan by SSS

- Must not have been granted final SSS benefits

- Borrower and spouse must be updated with their SSS loan payments, if any

Note: The spouse of an existing borrower may still qualify for a separate SSS housing loan IF:

- the existing loan of the borrower was acquired prior to marriage; and

- the loan is not tagged as ‘delinquent’

How to Apply

Interested and eligible members may file their loan application at the nearest SSS cluster branch or at the Housing and Business Loans Department located on the 5/F, SSS Bldg., East Avenue, Diliman, Quezon City.

Bring original copies of the following requirements:

- Mortgagor’s Application for Housing Loan with 1” x 1” photos of the Principal Applicant and Spouse

- Certificate of Loan Eligibility (CLE) – A PHP 100 service fee applies for this document.

- Certification from POEA/OWWA/DOLE/SSS Foreign Representative Office or from the Philippine Embassy/Consular Office

- Deed of Sale or Contract to Sell with statement of latest balance for acquisition of lot or house and lot

- Appraisal Report from the Home Guaranty Corporation and other accredited appraisal companies

- Certificate of Acceptance and Occupancy duly signed by the borrower (if property is 100% developed at the time of loan filing)

- Duly notarized Special Power of Attorney (if filing is through a representative)

Original and photocopies of the following:

- Owner’s copy of the Transfer Certificate Title (TCT)/Original Certificate Title (OCT)/Condominium Certificate of Title (CCT)

- Certified true copy of TCT/OCT/CCT issued by the Register of Deeds

- Latest Contract of Employment and latest Employer’s Certification duly authenticated by the Philippine Consulate

- Latest Property Tax Declaration and Realty Tax Receipt

Other Documents:

- Lot plan with vicinity map duly signed and sealed by Registered Surveyor or Geodetic Engineer (Blue Print)

- Building plans/specifications/picture of the house (Blue Print of the house)

- A set of twelve (12) post-dated checks covering twelve (12) monthly installments and to be repeated every twelve (12) months thereafter until the loan is fully paid

- Tax Mapping/Subdivision Plan

- Affidavit of Undertaking to continue paying monthly SSS premium contributions for the duration of the housing loan

Note:

- Provide the original and a photocopy of all required documents for verification.

- The principal (applicant) and spouse must be up-to-date with their loan payments with SSS upon verification.

- SSS holds the right to request additional documents, where necessary.

- Application Fee – Half of 1% of the loan amount or PHP 500, whichever is higher, but should not exceed PHP 3,000, which is to be deducted from the initial loan release.

- Inspection Fee – PHP 500 for applications within and outside of Metro Manila

Loan Details

The following are what can be considered as ‘allowable purposes’ for this type of loan:

- Construction of a new house or a residential unit on a lot owned by the member-applicant. The deed of land has to be free from lien/encumbrances;

- Procurement of a lot and construction of a new house or residential unit; and

- Acquisition of an existing residential unit, which may be a house and lot, a condominium unit, or a townhouse.

Important: The property subject of the loan has to be occupied by the owner-borrower, or his/her immediate family upon purchase.

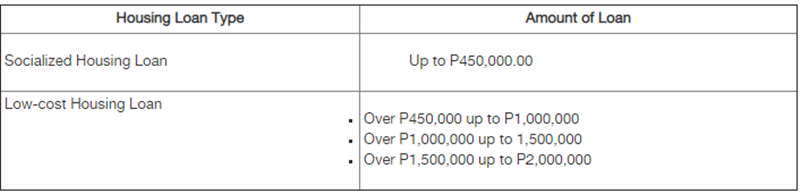

Loanable Amount

The maximum loanable amount is PHP 2,000,000.00. The loan grant shall be the lowest amount based on the following:

- Appraised value of collateral of at least 70% and not to exceed 90%

- The borrower’s capacity to pay

- The actual need of the borrower as detailed in the contract to sell or the scope of work or bill materials reviewed by SSS

Note: Up to three (3) qualified SSS members may share payment for a single loan up to the combined maximum individual availment for the loanable amount for the same collateral, as long as all co-payers are related within the first (1st) civil degree of kinship.

Loan Terms

The loan is payable in multiples of five (5) years, up to a maximum of fifteen (15) years.

Whereas the loan term is subject to the following conditions:

- The principal borrower must not be above 65 years of age at the time of loan maturity; and

- The loan term should not surpass the economic viability of the establishment as determined by the SSS appraiser.

(ALSO READ: SSS Soft-launches Loan Program for Pensioners)

Interest Rates

The following annual interest rates apply for the loan:

- Up to P450,000.00 – 8% p.a.

- Over P450,000.00 up to P1,000,000.00 – 9% p.a.

- Over P1,000,000.00 up to P1,500,000.00 – 10% p.a.

- Over P1,500,000.00 up to P2,000,000.00 – 11% p.a.

Allowable Collaterals

The acceptable collateral for this type of loan is the Transfer Certificate Title/Original Certificate of Title/Condominium Certificate of Title (TCT/OCT/CCT) issued by the Registry of Deeds in the name of the (principal) borrower and this must be free from any liens and/or encumbrances.

The first Real Estate Mortgage (REM) shall secure the loan for the house and lot to be financed. The REM shall be noted along with the member borrowers TCT/OCT/CCT and shall be registered with the relevant Registry of Deeds. The loan shall also be covered by an HGC guaranty.

In case the purpose of the loan is the purchase of residential condominium unit prior to actual construction (pre-selling), other residential property acceptable to SSS shall be submitted as collateral to secure the loan.

For which, the following are not accepted as collateral:

- Land type other than residential

- Less than 15 sq. meters floor area, in case of condominium units

- Less than 32 sq. meters lot area

- Road right of way is less than 1.5 meters

- Free/Homestead/Miscellaneous Sales Patent Titles

Insurance Coverage

- Fire Insurance

- Mortgage Redemption Insurance

- Home Guaranty Corporation Coverage

Note: The insurance premiums are to be shouldered by the borrower.

Payment Channels:

- PNB electronic overseas bills payment

- i-Remit online branches

- Ventaja online outlets

- WDS-Lucky Money online branches

- Metrobank online branches & subsidiaries

- BDO Remit Services

- RCBC Telepay Service

- BOC Remittance tie-ups

- AUB Ginto Hatid Express

- Bancnet online payments (www.bancnetonline.com)

- Branches or remittance tie-ups of accredited collecting banks

For more information regarding Direct Loan Housing Facility for OFWs, you or a representative may reach the SSS Housing and Business Loans Department through the following:

Address: 5th Floor, SSS Main Building, East Avenue, Diliman, Quezon City

Tel. No: 920-64-01 local 5121 to 5127

E-mail: member_relations@sss.gov.ph

They say time is one of the most invaluable resources we have at our disposal. True enough, by saving up for our future through financial platforms such as the SSS, we can put into good use the funds that we have accumulated over time in the form of valuable investments. (ALSO READ: 7 Business Ideas for OFWs to Invest In)