We all know that working overseas is not permanent. It is for this reason that we strive hard to save up and invest for our pension when we hit retiring age. And to help OFWs keep their contributions updated even as they are working overseas, the Social Security System (SSS) has devised an easier method for our kababayans to get their Payment Reference Number (PRN) even when they are abroad.

Also Read: How to Claim the SSS Unemployment Benefits

Earlier this year, the state-owned pension fund has employed the use of PRNs for every individual member contribution to effectively track payments into the system. With this system upgrade, member contributions are now updated and posted in real-time.

In this post, we will walk you through on how to generate a PRN for each of your member contributions:

SSS Employs Easier Payment Method of Contributions for OFWs

[Disclaimer: This article is shared for the purpose of information-sharing only. Any queries or specific concerns about your member contributions should be referred to an SSS representative or SSS office near you.]

Under the Real-Time Posting of Contribution (RTPC) Project of the Social Security System, a PRN will be issued for every member contribution transacted in any SSS branch, consulate or embassy with SSS office or any partner remittance centre. The new system update aims to speed up posting and accounting of member contributions. This will also be significantly helpful for OFWs based overseas, as the system can be readily monitored online.

For instance, if an OFW member decides to remit his/her 12-month Social Security contributions all at once, he/she can just perform this transaction on any of the SSS partner remittance agents, which will create a single PRN for the annual remittance — ensuring that it will be posted the next day.

This means that as soon as payment has been processed into the system, the contribution will be immediately posted (or credited) to your account, regardless of where you may be in the world.

Where to Get Your PRN When Based Overseas

For existing SSS members, you may generate PRNs via your My.SSS account.

Watch this video for a step-by-step guide on how to register a My.SSS account:

However, there’s still an even easier way. If you’re based overseas in countries such as the UAE, you can just check with the remittance agent if their system is linked to SSS through iRemit, Ventaja, or AUB. If so, they can just generate a PRN for you as your member contribution is posted automatically on the system after a successful transaction.

Tip: Always have a copy of your SSS membership details (i.e. SSS ID number or UMID) before you settle your member contributions.

Can OFWs Pay Their SSS Contributions for an Entire Year?

Yes. You can settle your annual payment by the end of August 2018, whereas payment for the October to December quarter can be settled by January 31 of the following year.

How Much Should OFWs Pay?

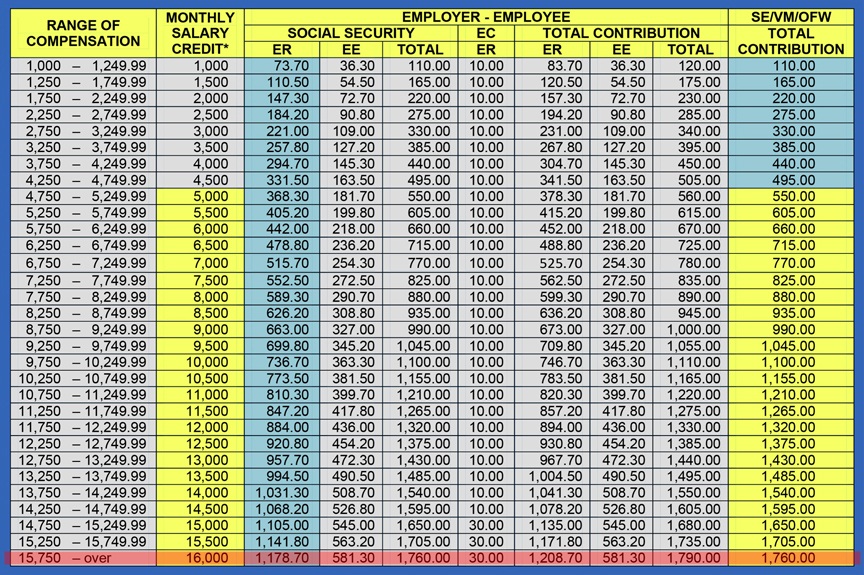

Generally speaking, monthly contributions are based on one’s salary bracket. You may refer to the table below as a general guide:

However, it is highly advisable for OFWs to pay the maximum monthly contribution of PHP 1,760 (USD 33) every month, as this entitles them to invest the extra amount in allocations of PHP 200 to their OFW Flexi Fund Account.

Tip: Make sure to download and read the instructions before you fill out the Flexi Fund application form.

Aside from the real-time posting of SSS contributions, the Philippine government is actively exploring new ways to provide assistance to OFWs through various programs and departmental initiatives in accordance to the President’s value for this sector.