Paying the Pag-IBIG Fund contributions regularly is very important for every employee, especially if they are to take advantage of all the benefits offered by the Home Development Mutual Fund (HDMF).

Also Read: Pag-IBIG Fund: What You Need to Know about Home Development Mutual Fund

It is particularly important to note if all the contributions are reflecting under your account, especially because one of the main requirements to avail of a home loan or any other Pag-IBIG loan is to have at least 24 monthly contributions. That said, it is important to see if you’ve fulfilled that requirement, and you can do so by checking your payments online via the Virtual Pag-IBIG platform.

If you need information on how to use the Virtual Pag-IBIG platform, you may check out the steps listed in our previous article on Virtual Pag-IBIG: How to Access Pag-IBIG Services Online.

What is the Consolidation of Records?

If you have worked in different companies in different locations, then it is highly likely that your Pag-IBIG contributions and records will not reflect on your Virtual Pag-IBIG account. This is, in fact, because your records are not yet consolidated.

Record consolidation refers to the Pag-IBIG Fund’s efforts to integrate its members’ data, regardless if it is from multiple sources due to a history of having worked for various employers or businesses, into a single destination record. During this process, different record sources of the members’ are put together or consolidated into a single member data record, which will be visible when you log into your Virtual Pag-IBIG account.

Why do you need to consolidate your Pag-IBIG contribution records?

If your Virtual Pag-IBIG account is not reflecting all the Pag-IBIG contributions paid under your name, then you would need to request a consolidation of your contribution records.

Other reasons that PAG-IBIG members would need to request for consolidation of records include:

- Having had numerous different employers in the past;

- Having plans to avail either a housing loan or a personal loan; or,

- Having discrepancies in their Pag-IBIG records, specifically their names.

How to consolidate my Pag-IBIG Fund records/contribution?

There are two different ways to process a consolidation/merging of records:

Option 1. Online

One way to consolidate your Pag-IBIG contribution record is to do it online, by sending the documentary requirements to Pag-IBIG Contact Center’s email address, contactus@pagibigfund.gov.ph.

If you opt to do it online, then here are the documents that you need to prepare:

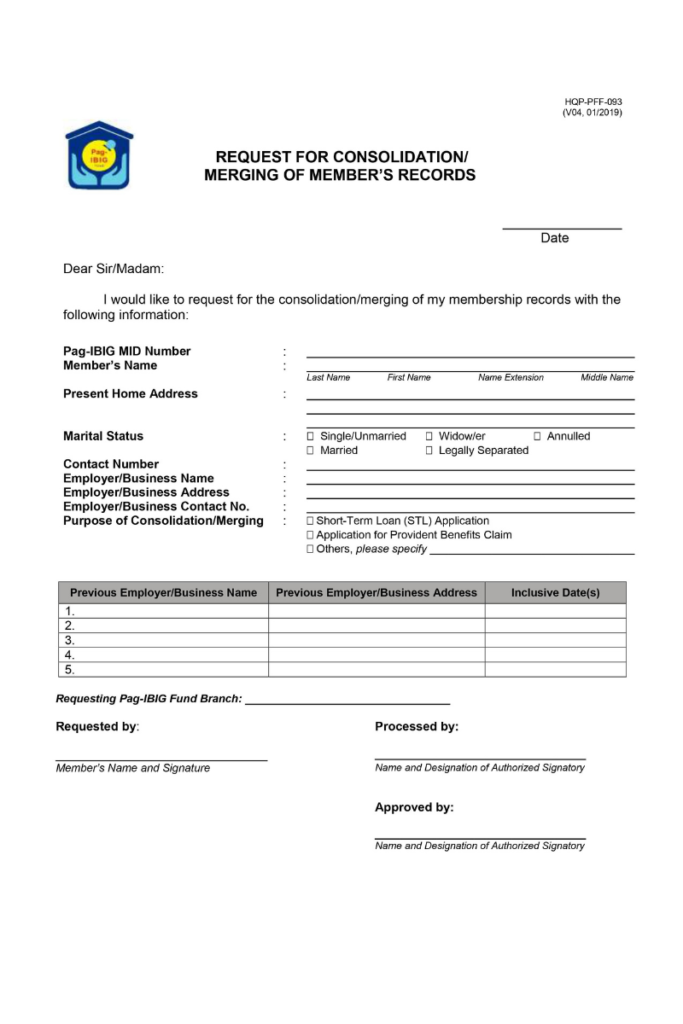

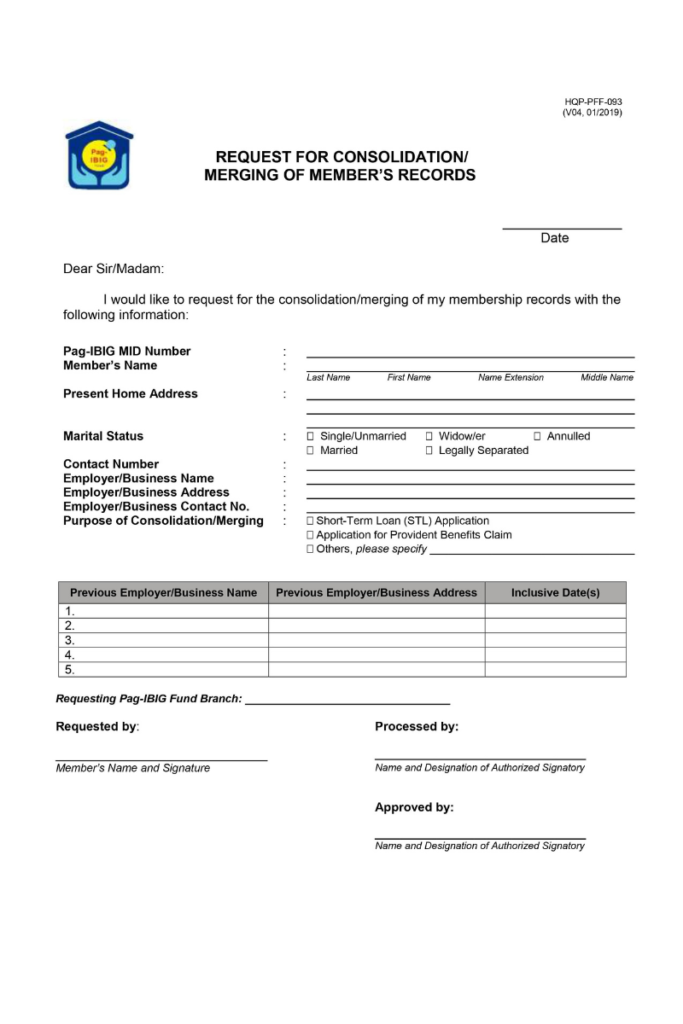

- Duly-accomplished Request for Consolidation/Merging of Member’s Records (HQP-PFF-093).

This form is downloadable from the Pag-IBIG website www.pagibigfund.gov.ph. You may also visit https://www.pagibigfund.gov.ph/document/pdf/dlforms/providentrelated/PFF093_RequestConsolidationMergingMembersRecords_V04.pdf. To complete this form, you will need to provide the following information:

-

- Member’s full name (First and Last names)

- Pag-IBIG Member ID (MID) Number

- Marital Status

- Contact Information

- Current employment status and employer information

- Purpose for consolidation

- Receiving branch where you want the record consolidated

- List of previous employers along with their business information in this format: Month – Year : Company Name: Main Address

- Scanned copy of at least two (2) valid IDs acceptable to the Fund in PDF or JPEG format.

Here’s a complete list of acceptable IDs to the Pag-IBIG Fund:

-

- Passport

- Driver’s License

- Professional Regulation Commission (PRC) ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Voter’s ID

- Barangay Certification or Barangay IDs or similar documents bearing picture of the member

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) Card

- Senior Citizen Card

- Overseas Workers Welfare Administration (OWWA) ID

- Overseas Filipino Worker ID

- Seaman’s Book or Seafarer’s Identification and Record Book (SIRB)

- Alien Certification of Registration/Immigrant Certificate of Registration

- Government Office and GOCC ID, e.g. AFD ID, Pag-IBIG Loyalty Card

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID

- Company ID issued by Private Entities or Institution Registered with or supervised or regulated either by the BSP, SEC or IC.

When sending a consolidation request via email, make sure the subject line reflects your PAG-IBIG Number and Service Type Request.

Certificate of Oneness, if applicable

Option 2. Walk-in application

If you live near a Pag-IBIG branch, or if for whatever reason, you have a deep-seated mistrust for conducting transactions online and you want to physically submit the request for consolidation of your Pag-IBIG records, you may also do so. Just bring the following documentary requirements to the nearest Pag-IBIG Branch to initiate the process:

- Duly-accomplished Request for Consolidation/Merging of Member’s Records (HQP-PFF-093) (1 Original).

This form is downloadable from the Pag-IBIG website www.pagibigfund.gov.ph. You may also visit this link https://www.pagibigfund.gov.ph/ document/pdf/dlforms/providentrelated/PFF093_RequestConsolidationMergingMembersRecords_V04.pdf to download the form.

To complete this form, you will need to provide the following information:

-

- Member’s full name (First and Last names)

- Pag-IBIG Member ID (MID) Number

- Marital Status

- Contact Information

- Current employment status and employer information

- Purpose for consolidation

- Receiving branch where you want the record consolidated

- List of previous employers along with their business information in this format: Month – Year : Company Name : Main Address

- Any of the valid ID listed above as acceptable to the Fund (1 Original)

Certificate of Oneness, if applicable

If you opt to personally initiate the request to consolidate your records, then do note that Pag-IBIG offices have specific operating hours. They are open from Mondays to Fridays (except holidays), from 9:00 am to 4:00 pm only.

Upon arriving at the Pag-IBIG Fund branch near you, the first thing you need to do is to tell the security officers that you are requesting for Pag-IBIG consolidation of records.

It usually takes time before your turn, so while waiting, you may make a list of all your previous employers and prepare to discuss it with the evaluator.

During your turn, the evaluator will check all your documents and records, then provide you with an Acknowledgement Receipt (AR) as proof that they have received your request and the relevant documents to process it.

Make sure to keep a record of the reference number provided to you via the Acknowledgement Receipt (AR).

Wait until the process is finished and you receive a confirmatory email. If you do not hear from them after 17 days, send an email to Pag-IBIG Fund to follow up on your request.

How to follow up on the request for Pag-IBIG consolidation of records

Regardless of whether the request for consolidation was done via email or in person, make sure to follow up on the request once the designated processing period has passed. To do so, you may send an email to Pag-IBIG Fund.

Things to remember when following up on your consolidation request:

- Send your inquiry to contactus@pagibigfund.gov.ph

- In the email’s subject line, include your PAG-IBIG Number and Service Type Request.

- Include the following details:

- Previous Employers’ Names

- Current Employer’s Name

- When and where the application for consolidation of Pag-IBIG records was submitted

- Member’s personal email address

- Member’s current Location or City

- Scanned copy of the Acknowledgement Receipt (AR), if available

Frequently Asked Questions (FAQs)

Though we have tried to be as detailed as possible on how you can go about processing a request to consolidate your Pag-IBIG Fund contribution records, it is impossible to be completely exhaustive. That said, we have listed some of the most frequently asked questions related to your Pag-IBIG Fund contribution records one way or another.

How long does it take to consolidate my Pag-IBIG contribution records?

Regardless if it is done online or in person, the processing time for the merging or consolidation of Pag-IBIG records takes up to 17 days and 52 minutes, as explained on the Fund’s Citizen Charter.

There’s a discrepancy in my full name and now, I now have a split or two records with the Pag-IBIG Fund. How can I consolidate these two records?

If you end up having two separate records due to an error or a discrepancy in your full given name, you will have to coordinate with the employer who made the mistake resulting in the discrepancy and request for a Certificate of Oneness.

My company, which made an error resulting in the discrepancy in the name on the Pag-IBIG Fund record, is no longer operational. How can I get a copy of the Certificate of Oneness?

If your previous company who made the erroneous name in your Pag-IBIG Fund record has already closed down or cannot be tracked due to any other circumstances like change of address, employer not responding, etc., you may submit a duly accomplished and notarized copy of the Joint Affidavit of Two Disinterested Person form. You will need to personally submit this to the nearest Pag-IBIG Fund branch, along with the other initial requirements to process the Merging or consolidation of your Pag-IBIG Fund contribution records as this type of request for application of Merging of Records can not be done via email.

Where can I get the Joint Affidavit of Two Disinterested Person form?

If you need it, the Joint Affidavit of Two Disinterested Person form is available and can be downloaded through the Pag-IBIG Fund website at www.pagibigfund.gov.ph and should be notarized.

Why should I bother consolidating my Pag-IBIG fund records?

Each member who contributes to the Pag-IBIG Fund can see that the contributions’ maturity date is within 20 years. This is equivalent to a total of 240 contributions. That said, if you decide that you do not want to avail of any PAG-IBIG financing benefits, you may still withdraw the lump sum of your contributions once your records reflect that you have made at least 240 contributions.

Aside from PAG-IBIG contributions, are there other savings programs on offer?

Yes. There’s also the Modified Pag-IBIG II (Pag-IBIG MP2) Savings Program, a special and voluntary savings facility with a 5-year maturity highly recommended to members, particularly to voluntary members, who wish to save more and earn even higher dividends. Or, if you simply wish to increase your contributions, you may also do so to increase your dividends. To do so, you may simply discuss it with your employer. Doing so will give you higher dividends than regular savings.

How else can I enjoy other benefits in PAG-IBIG if I don’t want to take out a loan?

You may if you register for a loyalty plus card. It offers its members the opportunity to enjoy several rewards programs and discount offers in different partner stores.

Is it easy to monitor rewards or savings in PAG-IBIG?

Yes. It’s quite easy to use as members have several options to do so.

First, any Pag-IBIG Fund member can just log into their Virtual Pag-IBIG accounts and see their dividends quarterly. So, If you, as a member, don’t have one yet, you’d want to register now.

For detailed steps on how to register for a Virtual Pag-IBIG account, you may check this guide on how to register and use the Virtual Pag-IBIG platform in this previous article entitled, Here’s How to Register as a Pag-IBIG Member Online.

You may send your contribution-related questions and personal information, along with a clear image of your valid ID via email as well. You will have to send it to contactus@pagibigfund.gov.ph and expect a reply after at least three working days.

One more way to check your Pag-IBIG contribution is to reach out to Pag-IBIG Fund by calling the Pag-IBIG hotline number at (02) 8724-4244 for any contribution-related questions. The hotline is available every Monday through Saturday, from 8 A.M. to 5 P.M. Note that this is one of the best ways to check your contributions as you won’t have to leave your home or office, and you’ll receive feedback immediately.

Another option is to send a personal message (PM) via the Pag-IBIG Fund Facebook page. We recommend sending a private message, though you can also post it as a comment, as this method will expose your confidential information to other Facebook users. Note that the Facebook admins of the HDMF usually take about three working days to respond.

You may also visit any Pag-IBIG Fund branch to verify your contributions, in case you do not yet have a Virtual Pag-IBIG account. To do so, just request for a copy of all your contributions, which will be given to you in a form called the Employee’s Statement of Accumulated Value (ESAV) or simply Pag-IBIG Contribution Printout. This document will show your membership information, number of contributions, employee contribution, employer contribution, dividends earned, and Total Accumulated Value (TAV).

If you are an OFW and you wish to check your Pag-IBIG contributions online, you may go through the OFW Member’s Contribution Verification. Note that this online service is exclusive to OFWs, and it enables them to view their contributions without having to travel to a Pag-IBIG overseas branch.

To use the online contribution verification system for OFWs, you just need to follow these steps:

- Access the OFW Member’s Contribution Verification system.

- Provide your information.

- Click “View Membership Savings.” This will show the total contributions paid (from the first to the last remittance) under your name.

- You may either print the page or save it as a PDF file for future reference.

- In the event that the online service for OFWs is not available, you may also send an email with your contribution-related questions and personal information, along with a clear image of your valid ID, to iog_tfssd@pagibigfund.gov.ph.

How soon will my MP2 contribution reflect on the record?

MP2 contribution payments generally reflect on the MP2 savings account within 2-3 business days, unless there are service interruptions, whether it is on the payment facility or the Virtual Pag-IBIG platform. Sometimes, however, there are errors, so it is important to check your online account in Pag-IBIG for any discrepancy in your payments. This will enable you to address it immediately.

It’s been 2 months since I initiated the request for consolidation of my Pag-IBIG records but until now, I have yet to receive an email confirmation. Is there a number I can call to follow up?

Yes. You may call the branch directly as they do not have a centralized merging department. However, it’s best to send an email inquiring about it to contactus@pagibigfund.gov.ph as they are more responsive on email. Just make sure to include the following details in the email:

- In the email’s subject line, include your PAG-IBIG Number and Service Type Request.

- Include the following details:

- Previous Employers’ Names

- Current Employer’s Name

- When and where the application for consolidation of Pag-IBIG records was submitted

- Member’s personal email address

- Member’s current Location or City

- Scanned copy of the Acknowledgement Receipt (AR), if available

You may also check this article on How to Contact Pag-IBIG Hotline for Inquiries.

Where can I request consolidation of my Pag-IBIG Fund records?

While you may check your contributions via any Pag-IBIG Fund branch, please note that you may only put in a request for consolidation at a regular Pag-IBIG branch. Note that satellite offices like the one in Ali Mall in Cubao do not handle consolidation requests.

For a complete list of Pag-IBIG branches, you may check our previous article on List of Pag-IBIG Branches in Every Region in the Philippines.

Final Thoughts

As a Pag-IBIG member, there is a lot of value to paying your contributions regularly, especially if you intend to take a home or a personal loan in the future. That said, it is important to check if they’re actually being remitted to the Pag-IBIG Fund. In order to see if the contributions are reflecting accurately, then it is a must to request a consolidation of your member data and contribution records, any which way you prefer.

Whether you are a regular local member or an OFWs, this will help you see that your contributions and your hard-earned money goes to where it should.