If you’re a seafarer in the Philippines and in need of financial assistance, a seaman loan may be the solution for you. However, finding a reliable lender that offers trusted seaman loans can be a challenge.

In the maritime industry, seafarers often face unique financial challenges due to the nature of their work. Fortunately, the Philippines offers several legitimate seaman loans tailored specifically for these professionals. Some prominent options include the OFW-EDLP, Pag-IBIG Multi-Purpose Loan, and SSS Salary Loan, just to name a few. These legitimate loan programs cater to seafarers’ specific requirements, offering competitive interest rates, flexible repayment terms, and efficient processing. Learn more about these loans by reading the rest of this guide.

Reasons for Getting a Seaman Loan

A seaman loan is a type of personal loan that is specifically designed for seafarers in the Philippines. It offers financial assistance to seafarers who need to finance various expenses such as tuition fees, medical bills, home repairs, and other personal needs.

Here are some of the common reasons why seafarers apply for a seaman loan:

- Education: Many seafarers apply for a seaman loan to fund their education or the education of their family members. This can include tuition fees, school supplies, and other related expenses.

- Medical Expenses: Seafarers may also require financial assistance to cover medical expenses for themselves or their family members. A seaman loan can provide them with the necessary funds to pay for medical bills, medications, and other related costs.

- Home Improvements: Seafarers who own a house or property may apply for a seaman loan to finance home improvements, repairs, or renovations.

- Personal Needs: Seafarers may also need a seaman loan to finance other personal needs such as purchasing a vehicle, paying for a wedding, or going on a vacation.

- Debt Consolidation: Seafarers may use a seaman loan to consolidate their debts and pay off multiple loans or credit card balances.

Overall, a seaman loan is a flexible and accessible financial option for seafarers in the Philippines who require financial assistance for various purposes.

It offers a quick and easy solution for funding personal expenses, education, medical bills, home improvements, and debt consolidation. However, it is important to carefully consider the terms and conditions of the loan before applying and to only borrow what you can afford to repay.

Top Seaman Loans

Seafaring jobs can be financially rewarding, but it’s not uncommon to find seamen in need of extra cash to finance their immediate or long-term goals.

Fortunately, there are many loan options available to seafarers to help them get the funding they need. Here are some of the most common types of loans that Filipino seafarers can apply for:

1. OWWA OFW Enterprise Development and Loan Program (OFW-EDLP)

The OFW-EDLP is an enterprise development and loan program offered by the Overseas Workers Welfare Administration (OWWA).

Although it is not specifically for seafarers, they can still apply for this loan as long as they are OFWs.

The loan provides up to Php 2,000,000 with an annual interest rate of 7.5% and a maximum repayment term of seven years (including two years of grace).

To qualify for this loan, seafarers must be active or non-active OWWA members and must complete the Enhanced Entrepreneurial Development Training (EEDT) before submitting a loan application.

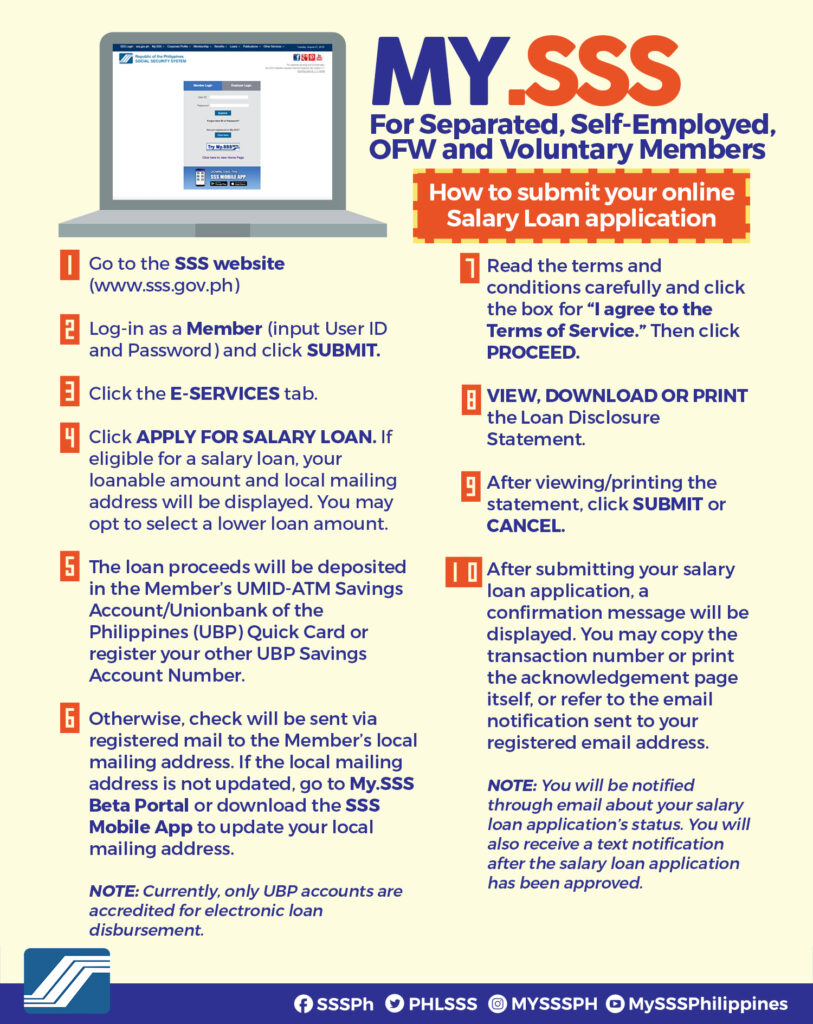

2. SSS Salary Loan

The SSS Salary Loan is a short-term loan available to seafarers who are also members of the Social Security System (SSS). The loan amount is based on the seafarer’s SSS contributions.

A one-month SSS Salary Loan is equal to the average of the last 12 monthly salary credits (MSCs) or the amount you applied for, whichever is less.

A two-month SSS Salary Loan is equal to double the average of your latest posted monthly salary credits, rounded up to the next higher amount or the amount applied for, whichever is the lower amount.

The loan has an interest rate of 10% per annum and a maximum repayment term of two years.

To apply for this loan, you need to be an active and paying SSS member with an SSS Digitized ID and two valid IDs such as a seaman’s book, passport, or postal ID.

3. Pag-IBIG Multi-Purpose Loan

The Pag-IBIG Multi-Purpose Loan is available to seafarers who are also members of the Pag-IBIG Fund.

With this loan, you can borrow up to 80% of your Pag-IBIG Regular Savings with an annual interest rate of 10.5%. The loan term is between 2 to 3 years.

To apply for this loan, you will need to submit your employment contract, Certificate of Employment and Compensation, an Income Tax Return filed with the host country, and a photocopy of your employer’s ID and passport.

4. AUB Seafarers’ Loan

This loan is ideal for seafarers who need a high-value loan with low-interest rates. You can borrow up to PHP 500,000 without making an advance payment or applying with a co-maker. Here are the steps to apply:

- Check the requirements and qualifications. You need to be a Filipino seafarer aged 21 to 60 years old, with at least one employment contract at the time of loan application, and a minimum gross salary of USD 800.

- Prepare the necessary documents, such as a photocopy of your employment contract with POEA stamp and Seafarers Registration Certificate (SRC), or Worker’s Information Sheet (WIS).

- Request a quotation to find out what the interest rate is.

- Apply online or visit the nearest AUB branch to submit your requirements and fill out the application form.

- Wait for the bank’s approval and release of funds, which can be done within 24 hours.

5. BPI Seafarer Loan

The BPI Seafarer Personal Loan is a fast cash loan available to Filipino seafarers aged 21 to 55. You can borrow from Php 20,000 to Php 300,000 with an interest rate of 1.5% per month and a loan term of five to nine months.

You can pay the monthly amortization by automatic debit, which eliminates the need for PDCs or over-the-counter payments.

To apply for this loan, you must have a government-issued ID with a picture, proof of income such as employment contracts, and the latest and unexpired signed POEA contracts or the latest proof of remittances for the past three months.

6. Sterling Bank of Asia Layag Seafarers’ Loan

To apply for the Sterling Bank of Asia OFW loan, you need to be a Filipino seafarer of legal age, with a promissory note or disclosure statement as collateral, and provide a photocopy of your OEC, POEA-signed contract, passport (completed pages), and Seaman’s Book (completed pages). Here are the steps to apply:

- Visit the nearest Sterling Bank of Asia branch and inquire about the Layag Seafarers’ Loan.

- Submit the requirements and fill out the application form.

- Wait for the bank’s approval and release of funds.

- Choose your repayment option – either through allotment deduction or assignment.

7. Security Bank OFW Loan

With attractive features like low interest rates, flexible repayment options of up to 48 months, and a minimum loan amount of PHP 100,000, the Security Bank OFW loan is designed to make your dreams come true.

Also, did you know that Security Bank has released the MarCoPay App?

MarCoPay App is the perfect solution for the maritime community and their families’ financial needs. This safe mobile e-wallet comes with dual currencies and is designed to provide convenient financial services. With MarCoPay App, you can now apply for a home or auto loan quickly and easily.

Enjoy low-interest rates, flexible features, and terms, and fast approval. Download the app today and experience its benefits firsthand. Don’t miss out on this opportunity to simplify your financial transactions. Get the MarCoPay App now and experience the ease of managing your finances.

8. Philippine Savings Bank (PSBank) OFW Loan

PSBank offers a quick loan solution that is accessible and reliable for borrowers. With loan amounts starting from ₱50,000 and up, and an impressively low interest rate of only 0.8%, PSBank makes borrowing convenient and affordable.

Their streamlined process ensures a fast and hassle-free experience. Whether you’re in the city or the countryside, PSBank is available everywhere, allowing you to access their loan services easily. Choose PSBank for a quick, reliable, and efficient loan experience.

Simply visit the nearest PSBank branch with your valid IDs, proof of income, and employment contract to apply. Don’t forget to check their website for additional requirements and important reminders.

9. BDO Unibank (BDO) OFW Loan

BDO Unibank (BDO) offers an OFW Loan designed to support overseas Filipino workers in achieving their financial goals. With competitive interest rates, flexible repayment terms of up to 36 months, and a minimum loan amount of PHP 10,000, this loan provides a convenient and accessible financing solution.

To apply, visit the BDO website or any BDO branch near you. Make sure to bring your proof of overseas employment, valid IDs, and income documents for a smoother application process.

10. PBCom OFW Loan

PBCom understands the financial aspirations of seafarers working abroad and provides a PBCom OFW Loan tailored to their needs. This loan offers flexible payment terms, low interest rates, and quick processing. Whether you want to support your family’s needs, start a business, or invest, PBCom is here to help you achieve your goals.

Did you know that you can conveniently monitor the due dates of your loan accounts through POP? With POP’s all-digital banking platform, you can stay on top of your payments anytime and anywhere! Simply download the app to access this awesome feature and experience the convenience of managing your loans digitally. To learn more about the amazing features of POP, click here and discover the power of hassle-free online banking with POP!

Visit the PBCom website or any PBCom branch to get started with your application. Remember to bring your valid IDs, proof of income, and employment contract for a successful application.

11. Metrobank OFW Loan

Metrobank acknowledges the hard work and dedication of seafarers abroad and provides an OFW Loan to address their financial needs. With competitive interest rates and flexible repayment terms, Metrobank’s OFW Loan offers the necessary funds for various purposes such as house construction, business expansion, or family support.

To begin your application, visit the Metrobank website or any Metrobank branch near you. Prepare the required documents such as proof of income, valid IDs, and proof of overseas employment.

12. ChinaBank OFW Loan

ChinaBank understands the financial aspirations of seafarers and offers their Chinabank OFW Loan to support their goals. With competitive interest rates at 0.75% p.a. and flexible repayment options of up to five years, ChinaBank aims to provide seafarers with the financial assistance they need. Whether it’s for home renovation, education, or investment, ChinaBank has a solution for you.

Visit the ChinaBank website or any ChinaBank branch and bring your valid identification cards, proof of income, and proof of overseas employment to apply today.

13. RCBC OFW Loan

RCBC OFW Loan is designed to assist overseas Filipino workers in meeting their financial needs effectively. This loan offers attractive features, including low interest rates, flexible repayment terms of up to 36 months, and a minimum loan amount of PHP 50,000.

Applying for the loan is hassle-free: visit any RCBC branch or apply online through their website. Ensure you have the necessary documents such as valid IDs, proof of income, and employment contract. Fulfill your financial goals as an OFW with RCBC OFW Loan today.

14. UnionBank OFW Loan

UnionBank offers an OFW loan that can help you achieve your financial goals. This loan offers flexible repayment terms of up to 36 months, competitive interest rates, and a minimum loan amount of PHP 50,000.

To apply, simply visit any UnionBank branch or fill out the online application form on their website. Remember to prepare your valid IDs, proof of income, and other necessary documents. Take advantage of this loan and secure your future today.

15. LandBank OFW Loan for Seafarers

LandBank OFW Loan is designed specifically to cater to the financial needs of overseas Filipino workers (OFWs). With competitive interest rates, flexible repayment terms of up to 36 months, and a minimum loan amount of PHP 100,000, this loan aims to provide OFWs with access to funds for various purposes such as home renovation, education, investment, or debt consolidation.

To apply, OFWs can visit any LandBank branch or access the online application form on the LandBank website. Remember to bring your valid IDs, proof of income, employment contract, and other required documents. Don’t miss out on this opportunity to fulfill your financial goals and secure a better future for you and your family.

Warnings and Tips when Getting a Seaman Loan

Getting a seaman loan can be a helpful solution for Filipino seafarers in need of financial assistance.

However, before applying for a seaman loan, it’s essential to keep in mind some warnings and tips to avoid potential issues down the line.

Warnings:

- Beware of lenders offering high-interest rates: Some lenders may take advantage of seafarers who urgently need cash and offer loans with high-interest rates. Always compare the interest rates and fees of different lenders to find the best deal.

- Be cautious of lenders with hidden fees: Some lenders may have hidden fees, such as processing fees or early repayment penalties. Always read the loan contract carefully and ask about any fees that may apply.

- Avoid borrowing more than you can afford: Only borrow what you need and can afford to repay. Don’t get tempted to borrow more than you can repay because it can lead to a debt spiral that can be difficult to get out of.

- Avoid loan sharks: Loan sharks may offer loans with no collateral and easy application, but they can charge exorbitant interest rates and harass borrowers who fail to pay. Always borrow from reputable lenders and avoid loan sharks.

Tips:

- Check the lender’s reputation: Do some research and check the lender’s reputation before applying for a loan. Look for reviews and feedback from previous clients to gauge their experience and reliability.

- Understand the loan terms and conditions: Always read and understand the loan contract before signing. Ask the lender to clarify any terms or conditions that you don’t understand.

- Shop around for the best deal: Compare the loan offerings from different lenders to find the best deal. Consider the interest rates, fees, and repayment terms.

- Plan your repayment: Plan your repayment before applying for a loan. Consider your income and expenses and determine how much you can afford to repay each month. Stick to your repayment plan to avoid defaulting on the loan.

- Use the loan for its intended purpose: Use the loan only for its intended purpose, whether it’s for personal expenses, business, or investment. Avoid using the loan for unnecessary expenses or luxuries.

Video: Salary loan SSS online 2022 / Loan for Seaman/OFW

If you’re an OFW-member of the Social Security System (SSS) in the Philippines, you may be eligible for a salary loan to help you meet your financial needs.

In this video, we’ll provide you with valuable information on how you can apply for a salary loan in SSS. We’ll walk you through the step-by-step process of applying for a salary loan, including the requirements you need to submit and the eligibility criteria you need to meet.

Frequently Asked Questions

1. What is a seaman loan, and why do seafarers need it?

A seaman loan is a type of loan designed for Filipino seafarers who need financial assistance for various purposes. Seafarers may need a seaman loan to cover expenses related to their work, such as training, certification, or equipment, or to address personal needs, such as home repairs or medical expenses.

2. What are the requirements for getting a seaman loan in the Philippines?

The requirements for getting a seaman loan vary depending on the lender. However, most lenders require seafarers to be of legal age, have a valid Overseas Employment Certificate (OEC), a POEA-signed contract, and a Seaman’s Book. Some lenders may also require proof of income, such as a payslip or bank statement.

3. Can seafarers with bad credit still apply for a seaman loan?

Yes, seafarers with bad credit can still apply for a seaman loan. However, they may need to provide additional requirements or collateral to secure the loan. Some lenders may also charge higher interest rates for borrowers with bad credit.

4. What is the maximum loan amount that seafarers can borrow in the Philippines?

The maximum loan amount that seafarers can borrow in the Philippines varies depending on the lender and the borrower’s qualifications. Some lenders offer seaman loans ranging from PHP 10,000 to PHP 500,000, while others may offer higher loan amounts for eligible borrowers.

5. Can seafarers use the seaman loan for personal expenses?

Yes, seafarers can use the seaman loan for personal expenses, such as home repairs, medical bills, or education expenses. However, it’s essential to use the loan wisely and only for necessary expenses.

6. How long does it take to process a seaman loan application?

The processing time for a seaman loan application varies depending on the lender. Some lenders offer fast loan processing and can release the loan proceeds within 24 hours, while others may take several days to process the application.

7. How can seafarers choose the right lender for their seaman loan?

Seafarers can choose the right lender for their seaman loan by comparing the interest rates, fees, repayment terms, and loan features of different lenders. It’s essential to choose a reputable lender that offers transparent and flexible loan terms and has a track record of providing quality customer service.

8. What are some factors to consider when choosing the right Seafarer loan?

- Interest rates: The interest rates can significantly affect the total cost of the loan, so it’s essential to choose a lender that offers competitive interest rates.

- Fees and charges: Lenders may charge various fees and charges, such as processing fees, late payment fees, or prepayment fees. Seafarers should compare these fees and charges across different lenders to find the most affordable option.

- Loan amount and repayment terms: Seafarers should consider the loan amount and the repayment terms offered by the lender. It’s important to choose a loan amount and repayment term that fits their budget and financial goals.

- Loan processing time: Seafarers who need quick access to funds may want to consider lenders with fast loan processing times.

- Reputation and customer service: Seafarers should choose a reputable lender with a good track record of providing quality customer service. Reading reviews and testimonials from other borrowers can be helpful in evaluating a lender’s reputation.

- Loan requirements: Seafarers should check the loan requirements of each lender to make sure they are eligible to apply for the loan. Some lenders may require additional documents or collateral, which can affect the loan application process.

Summary

In conclusion, seaman loans can be an excellent source of financial assistance for seafarers in the Philippines who need extra funds for various reasons. Whether it’s for emergencies or personal expenses, seaman loans can provide seafarers with the necessary funds to meet their financial obligations.

By knowing where to avail of trusted seaman loans in the Philippines and considering the factors we’ve mentioned in this guide, seafarers can make an informed decision when choosing the right lender and loan for their needs.

With the right lender and loan, you can gain access to the financial support you need to achieve your goals and secure your financial future.

READ NEXT: How to Get an Online Loan for OFWs