Every OFW dreams to become financially stable. However, this might not happen right away, so some help might be needed. If not for long years and several jobs taken overseas, one of the most practical ways to get some help when it comes to financing is through a bank loan.

If you are an Overseas Filipino Worker (OFW) and would like to apply for a loan, Landbank has the loan program for you. The Landbank OFW Loan is designed to help OFWs access the money they need to finance their various needs, such as housing, education, and business ventures.

Also read: 13 Best OFW Loans in the Philippines (Banks and Government Agencies)

These bank loans can be taken out for various purposes: personal, housing, car, and so on. It’s important for OFWs though (or anyone for that matter) to take out the right loan that matches their personal goals and objectives. In this guide, we share some useful facts and tips when applying for a bank loan from one of the Philippines’ longest-running banks – the Landbank of the Philippines.

If you plan to get a loan for whatever purpose you may have as an OFW, keep reading below to learn more.

The Ultimate Guide to Getting a Landbank Loan for OFWs

Most banks today provide credit cards, loans, and investment options in addition to savings and deposit accounts. One of these banks is the Landbank of the Philippines, the country’s largest government bank.

This government bank, commonly known as Landbank, provides loans not just to government personnel but also to foreign Filipino workers (OFWs).

The Landbank OFW Loan, part of the “Reintegration Program,” intends to assist OFWs in completing their goal for companies in the country. A business can provide an OFW with an alternate source of income.

List of Landbank Loan for OFWs

Whether you want to start a business or property investment back in the Philippines, there’s no doubt that getting some financial support – in the form of loans, can help you get that much-needed ‘wind’ to help your plans take off from the ground.

Here are the 3 categories of Landbank loans for overseas Filipino Workers.

- Landbank Personal Loans

- Landbank Housing Loans

- Landbank Business Loans

Landbank Personal and Housing Loan Options

There are various loans offered by the Landbank of the Philippines on top of their other features and services, such as opening a savings deposit account or applying for a credit or debit card.

Landbank offers three types of personal loans, which are:

Easy Home Loan

This home financing offer is available for the purchase of a townhouse, condominium unit, residential lot, house and lot, or other residential property. To be qualified for this loan, the applicant must meet the following criteria:

- a Filipino citizen

- at least 21 years old but not more than 65 years old on the maturity date of the loan

- employed or self-employed

What is the maximum loan term for the Landbank Easy Home Loan?

You have the option of repaying the loan over a period of up to twenty (20) years. The loan amount must be at least Php 500,000.00. The amount you can borrow is subject to the bank’s approval.

End Buyer’s Tie-Up Facility

The Landbank End-Tie-Up Buyer’s Facility is now available for the purchase of a residential lot or a property that is ready for occupation. It is also possible to utilize it to fund the construction of a dwelling. The following conditions must be met in order to be eligible for this offer:

- Developers which have current credit lines with the bank

- Developers and subsidiaries who passed the “Accreditation Process” although it has no existing credit lines with the bank

What is the maximum loan term for End Buyer’s Tie-Up Facility?

Aside from communal housing, the maximum credit duration for other residential properties is twenty (20) years. The latter may be paid for a period of up to thirty (30) years. The maximum loanable amount is up to 90% of the property’s contract price.

Landbank Housing Loan: Bahay Para sa Bagong Bayani (3B)

The 3B is also one of the Landbank housing Loans. It is available to help with the purchase of a residential lot, a house and lot, a condominium unit, or a townhouse.

You may also apply for this offer if you want to refinance an existing home loan, build or renovate a property held by an OFW, or assume a house owned by an OFW. In order to be qualified for this loan, the applicant must be:

- a Filipino citizen

- at least 21 years old but not more than 65 years old on the maturity date of the loan

- an OFW holding a live contract from a reputable company

- clear of adverse credit finding with other creditors

What is the maximum loan term for Bahay Para sa Bagong Bayani (3B)?

The maximum loan length under the 3B is determined by whether or not the applicant has a co-borrower. If the applicant has a co-borrower, he or she may pay off the loan over a period of up to twenty (20) years; however, if the applicant does not have a co-borrower, the maximum loan duration is fifteen (15) years. The minimum loanable amount under this offer is equal to the OFW’s lowest-paying capacity.

How to Download Landbank Loan Form

One of the document requirements you need to secure is the loan registration form or the Landbank Loan form. Please visit the official website of Landbank in order to download the loan application form.

To apply for any of the loans or finance products listed in this guide, you may visit this page to get the relevant forms that you need.

What are the Landbank Housing Loan Rates?

In case you are wondering what is the housing loan rate from Landbank, based on their website, there is a 6.5% interest rate of the loanable amount. It is important that you consult the Landbank agent to verify the interest rate according to the number of years of your housing loan term.

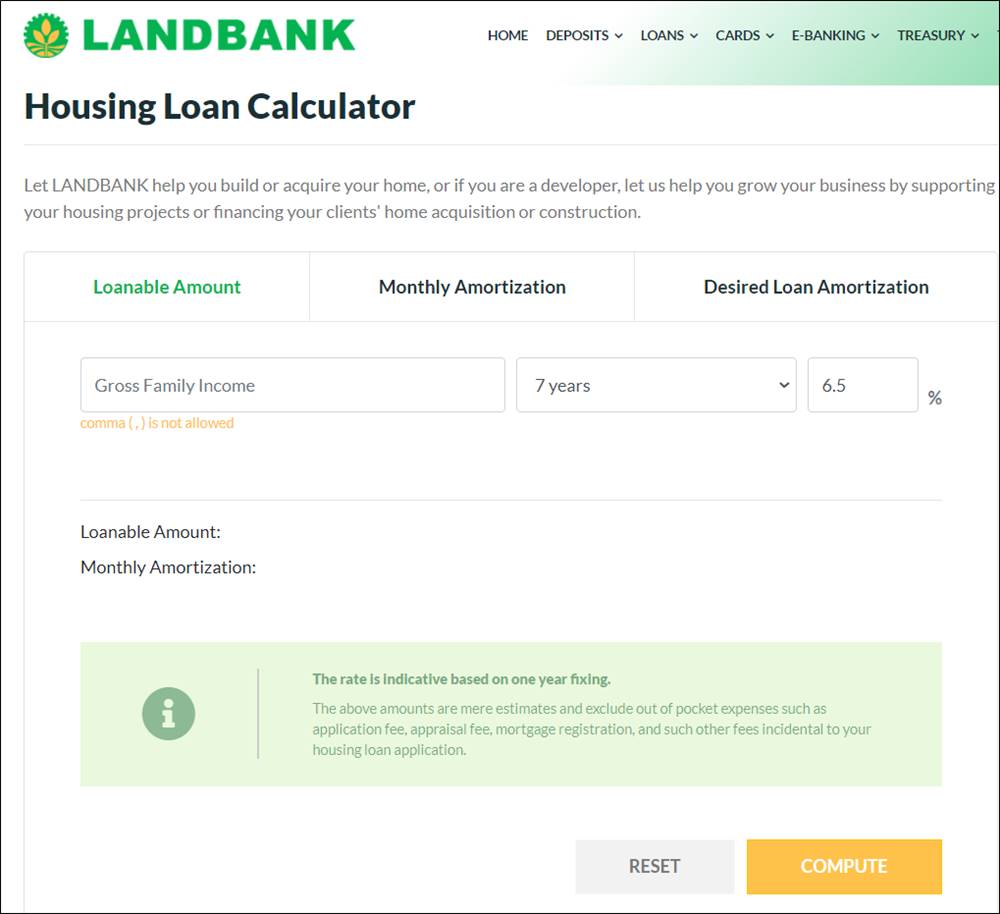

How to Use Landbank Loan Calculator to Compute Monthly Amortization

The bank offers a loan calculator to help you compute an estimated loan amount and payment option. The calculator is a page where you can enter your Gross Family Income, the Desired Term of Loan, and then the corresponding interest rate. This gives you a better idea of how much money you need to come up with upfront and to understand your terms of payment. It is quite a very useful tool.

The categories in this calculator include the Loanable Amount, the Monthly Amortization, and your Desired Loan Amortization.

Below is a screenshot of the Loan Calculator:

You may access the housing loan calculator by visiting this page – https://www.landbank.com/housing-loan-calculator

Landbank Business Loans: OFW Reintegration Program

Overseas Filipino Workers now have access to business opportunities thanks to a collaboration between Landbank and the Overseas Workers Welfare Administration (OWWA), which oversees the welfare of overseas Filipino workers (OFWs), the country’s second-largest source of foreign capital after value-added exports such as electronic components, and a major source of private consumption, which in turn supports the economy (GDP). You can now set up and run your own business as an alternative to your overseas employment with this bank’s financial support.

The Landbank OFW Reintegration Loan Program is available to, but not limited to, franchise businesses, agricultural and non-agricultural production and marketing, building, trading, renting, service, and transportation.

Who are eligible for this Landbank Business loan?

To be qualified to apply for the loan under the OFW Reintegration Program, the candidate must meet the following requirements:

- an OFW who is a member of the Overseas Workers Welfare Administration (OWWA)

- a participant in a capacity-building program

The projects you may use this loan for include those in the following fields:

- franchising,

- agricultural,

- non-agricultural production,

- marketing,

- construction,

- rental,

- service,

- trading, and

- transportation

This loan program is also viable for a contract tie-up with 1,000 corporations

Landbank’s minimum loan period is one (1) year. The maximum loan length, including the two-year grace period, is seven (7) years. To apply, go to the Landbank branch closest to you.

What Can I Use the Land Bank Business Loan for?

- Working capital – finance your start-up or existing business to get the leverage it needs to get to the next level.

- Fixed asset acquisition – invest in a property that you can use for your future plans when you return to the Philippines.

Project Cost-Sharing

- Borrower’s Equity – Minimum of 20% of the Total Project Cost (TPC)

- Loan – Maximum of 80% of TPC

How Much Can I Take Out from this Business Loan Program?

A minimum loanable amount of Php 100,000 can be taken out, with the following loan ceilings:

- Php 2 million for single proprietorship

- Php 5 million for group of OFWs (partnership, corporation, or cooperative)

Interest Rate for the OFW Reintegration Program

Short Term Loan and Term Loan – 7.5% per annum fixed for the duration of the loan

What is the Payment Structure for the Loan under the OFW Reintegration Program?

- Short Term – maximum of one year

- Term Loan – based on cash flow but not to exceed seven years, inclusive of a maximum two years grace period on principal

Does this Bank accept Collateral?

Yes, the object of financing and/or other collaterals/securities are acceptable to the bank.

How Can I Avail of this Loan?

- Visit your local OWWA office and go through orientation/eligibility screening, as well as processing/necessary training.

- Obtain the necessary OWWA certification for submission to Landbank.

For more information and to have your project proposal evaluated, go to the LANDBANK Lending Center/Lending Unit closest to your home or company.

Landbank Loans for General / Small & Medium Enterprises

Through its loan programs, Landbank assists enterprises. With a presence in all 81 provinces across the country, entrepreneurs may get the help they need to start or expand their existing businesses no matter where they are in the country.

Term Loan Facility

You may apply for this loan type if you need some financial assistance for your business’ capital expenditure.

Purposes for getting a term loan

- finance business expansions

- purchase of additional machinery and equipment / fixed asset acquisition

- finance permanent working capital arising from expanded operations

- project financing

Who are the eligible borrowers?

- Single Proprietorship

- Partnership

- Corporation

What are the eligible projects?

- Agri-business

- Manufacturing

- Trading

- Services

List of Documentary Requirements

Pre-Processing Requirements (Single Proprietorship)

- LANDBANK Loan Application Form

- Bio-data of borrowers with passport-size ID picture

- Photocopy of Certificate of Registration with the

- Department of Trade and Industry

- Mayor’s Permit

- Photocopy of Internal Tax Revenue and audited (BIR-received) Financial Statement for the last three years

- Latest interim Financial Statement

- Projected income statement, balance sheet

- and cash flow statement with basic assumptions

- Brief history of the Business

Pre-Processing Requirements (Partnership and Corporation)

- LANDBANK Loan Application Form

- Photocopy of Certificate of Registration with Department of Trade and Industry, Securities and Exchange Commission or Board of Investments

- Certified True Copy of Articles of Incorporation/Partnership and by-laws

- Board Resolution authorizing the management to obtain loan from LANDBANK and designating the authorized signatories

- Notarized list of the following (certified by the Corporate Secretary for corporations):

- Officers

- Partners (for Partnerships only)

- Board of Directors (for Corporations only)

- Principal stockholders and their stockholdings (for Corporations only)

- Bio-data of borrowers or proprietors, partners, key officers,

- Board of Directors with passport-size ID pictures

- Sworn Statement of Assets and Liabilities of borrowers/proprietors. partners, key officers, and Board of Directors

- Photocopy of Internal Tax Revenue and audited (BIR-received)

- Financial Statement for the last three years

- Latest Interim Financial Statement

- Projected income statement, balance sheet, and cash flow statement with basic assumptions

- Brief history of the business

Working Capital and Liquidity Support Facilities

For individuals who require help for their businesses’ day-to-day operations, here are some of the facilities you can look into to get the assistance that you require.

Short-term Loan Line

- purchase of raw materials or finished goods inventories

- financing of accounts receivable

- financing of contracts

Import/Domestic Letter of Credit (LC) / Trust Receipt (TR) Line

- payment for the importation of goods from local or offshore suppliers

Domestic Standby LC Line

- guarantee borrower’s performance of service or purchases from local suppliers

Domestic Bills Purchase Line

- purchase of check for immediate credit to deposit account without waiting for the clearing period.

Who are the eligible borrowers?

- Single Proprietorship

- Partnership

- Corporation

What are the eligible projects?

- Agri-business

- Manufacturing

- Trading

- Services

List of Documentary Requirements

Pre-Processing Requirements (Single Proprietorship)

- LANDBANK Loan Application Form

- Bio-data of borrowers with passport-size ID picture

- Photocopy of Certificate of Registration with the

- Department of Trade and Industry

- Mayor’s Permit

- Photocopy of Internal Tax Revenue and audited (BIR-received) Financial Statement for the last three years

- Latest interim Financial Statement

- Projected income statement, balance sheet

- and cash flow statement with basic assumptions

- Brief history of the Business

Pre-Processing Requirements (Partnership and Corporation)

- LANDBANK Loan Application Form

- Photocopy of Certificate of Registration with Department of Trade and Industry, Securities and Exchange Commission or Board of Investments

- Certified True Copy of Articles of Incorporation/Partnership and by-laws

- Board Resolution authorizing the management to obtain loan from LANDBANK and designating the authorized signatories

- Notarized list of the following (certified by the Corporate Secretary for corporations):

- Officers

- Partners (for Partnerships only)

- Board of Directors (for Corporations only)

- Principal stockholders and their stockholdings (for Corporations only)

- Bio-data of borrowers or proprietors, partners, key officers,

- Board of Directors with passport-size ID pictures

- Sworn Statement of Assets and Liabilities of borrowers/proprietors. partners, key officers, and Board of Directors

- Photocopy of Internal Tax Revenue and audited (BIR-received)

- Financial Statement for the last three years

- Latest Interim Financial Statement

- Projected income statement, balance sheet, and cash flow statement with basic assumptions

- Brief history of the business

Summary

There are several loan programs available for OFWs to apply. So as somebody who is working abroad, you should be aware of your options. You also need to make sure that you secure all the necessary documents and also make sure you are qualified for the program you are applying.

With these financial products, you can have the much-needed help and support to get your business or investment started, regardless of the stage, it is in. Just make sure to take note of all the eligibility criteria and requirements you need to comply with and you should be good to go!

Contact Information

Landbank of the Philippines is regulated by Bangko Sentral ng Pilipinas.

Tel No: (+632) 8-708-7087; Customer Care Hotline: (+632) 8-405-7000

Email Address: customercare@mail.landbank.com

Website: www.landbank.com

Facebook Page: facebook.com/landbankofficial/

SMS (for Globe users only): 021582277

BSP Facebook – http://www.facebook.com/BangkoSentralngPilipinas/

READ NEXT: How to Apply for SSS Retirement Claim Philippines 2021